We are a technology company.

—Lloyd Blankfein, CEO of Goldman Sachs, 20151

What exactly is financialization? How does it relate to what’s happening in the rest of the economy? Does it hinder growth, and if so, how? At the end of the nineteenth century, many on both the left and right regarded finance as a vampire sucking the lifeblood out of “real” businesses, workers, and, in Britain’s settler colonies, local economies. Indeed, Stanford literature professor Franco Moretti has argued that the classic 1897 Bram Stoker novel Dracula, which birthed the modern vampire mythos, reflected British manufacturers’ fears of competition from new American and central European firms (primarily German) backed by powerful banks.2 Contemporaneous and more prosaic American and German economists also observed how finance encompassed and encumbered nonfinancial firms. The final third of Thorstein Veblen’s still relevant Theory of the Business Enterprise (1904) dissects how U.S. financial elites used the stock market to consolidate and control industry. Shortly after, in 1910, the Marxist and later Weimar-era finance minister Rudolf Hilferding comprehensively analyzed banks’ preeminent power in the German economy.3

One century later, the same debate and language has resurfaced. Matt Taibbi famously called Goldman Sachs “a great vampire squid wrapped around the face of humanity.”4 But with Hollywood totally dependent on financial firms to capitalize its increasingly expensive and risky gambles, the focus in popular culture has shifted from vampires to the zombie firms they leave behind—bloodless, battered, neither bankrupt nor bountiful, shuffling around aimlessly in search of better corporate governance that might restore them to their prior profitable state.5

Academics of course also picked up this discourse, albeit under the less evocative labels “financialization” and “shareholder value model.” These arguments boil down to four main points. First, financial firms and nonfinancial corporations (NFCs) have opposing interests. Second, fights for control over NFCs in the stock market have forced NFCs to boost dividend payouts and share buybacks to the detriment of productive investment—the shareholder value model writ narrowly—and this is particularly true for American firms. Third, decreased investment necessarily hinders economic growth by reducing both productivity gains and aggregate demand. Fourth, households borrowing to supplement feeble wage growth can temporarily substitute for the missing aggregate demand, but at the cost of potential financial crises like that of 2008. The transformation of more and more income streams—student loans, credit card receivables, auto loans, leases—into securitizable assets connects all four themes. The financialization literature sees American households as the poster children for reckless borrowing, followed by U.S. NFCs using debt to execute share buybacks. By contrast, abstemious Germans and Japanese have less financialized economies.

This is a reasonable read of the situation. But as in Stoker’s Dracula, misdirection conceals the identity of some of the villains and the nature of the problem. In Dracula, of course, the eponymous villain hails from the darkness of central Europe. Our heroes by contrast are all English, excepting one American, Quincy Morris. But Morris cuts a rather ambiguous figure. While he is kin to the English protagonists—not a Morrisberg or Morrisoni or Morrisovic—he seems to possess too much knowledge of vampires, and his efforts to help defeat Dracula all go suspiciously awry. As Moretti points out, the final page of the novel leaves Morris dead, and thus, presumably, all vampires vanquished, not just the central European ones.

Just so a slice of the NFCs that are theoretically in opposition to vampire finance today, and just so a slice of financial firms. The lines of conflict do not line up as neatly as the academic literature and popular imagination might suggest. If we return to the four arguments above, the reality is not that finance uniformly opposes and bleeds NFCs, but rather that a set of firms—exploiting what Michael Lind has called “tollbooth” power—opposes a much larger set of firms, zombies included, lacking this power.6 Put simply, the profit data show that a handful of key financial firms that increasingly look like “tech” firms, and a handful of key tech firms that increasingly look like financial firms, have been capturing the bulk of profits in the U.S. economy.7 These two vampires underinvest, slowing growth.

Second, and counterintuitively, the profit data similarly show that in most rich countries the broad financial sector captures a larger share of cumulative national profit than does finance in the United States. Figure 1 shows the share of cumulative profit captured by either all financial firms (NACE codes 64–68, basically finance, insurance, and real estate) or just traditional banks and holding companies (NACE 64) as a percentage of cumulative profits captured by all nationally headquartered firms with annual revenue over $100 million in any year between 2011 and 2019. That share is lower in Germany, Japan, and Switzerland relative to the United States, but the gap between the United States and Germany is only 3 percentage points, versus a much larger gap at the right side of the figure. Third, the United States has consistently outgrown most of those other rich economies regardless of how you measure that growth. So there may be some truth to the “vampires equal slower growth” argument, but the United States is hardly the poster child for that claim. In any case, the evidence here is quite mixed. Most of the countries in which banks capture a large share of local profits had faster growth from 1995 to 2019 than the ones with smaller shares.

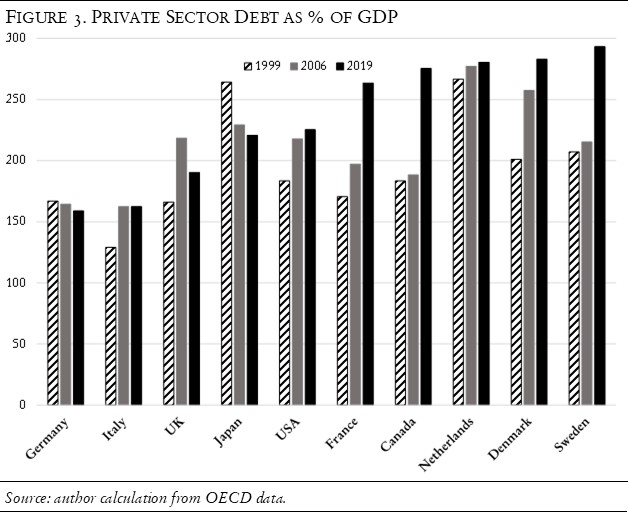

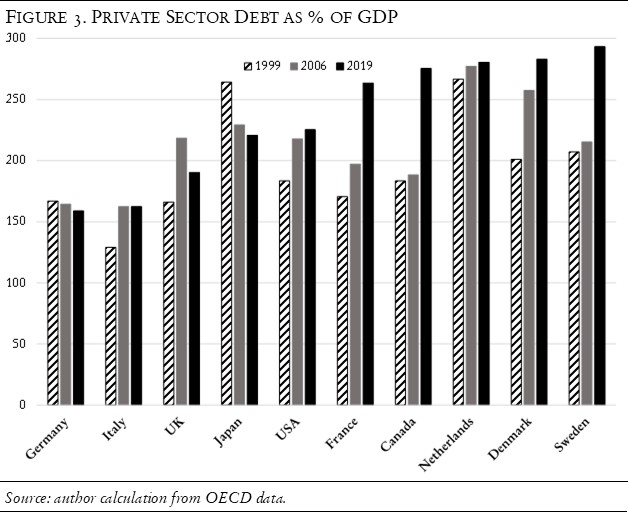

Similarly, U.S. households are not now and have not been the most indebted in the world relative to household disposable income (figure 2).  Even at the peak of borrowing in 2006, U.S. households were less encumbered than many northern European households and at basically the same levels as allegedly un-financialized German and Japanese households. Indeed, U.S. households have saved more of their disposable income than Japanese households for the past fifteen years. Finally, U.S. corporate debt levels relative to GDP are also at the lower end of the larger OECD economies (figure 3).

Even at the peak of borrowing in 2006, U.S. households were less encumbered than many northern European households and at basically the same levels as allegedly un-financialized German and Japanese households. Indeed, U.S. households have saved more of their disposable income than Japanese households for the past fifteen years. Finally, U.S. corporate debt levels relative to GDP are also at the lower end of the larger OECD economies (figure 3).  So while there may be some truth to the argument that household debt substitutes for investment, the growth, investment, and household debt data don’t really line up in the expected way, unless we take a “quantity has a quality of its own” point of view. Here the much larger size of the U.S. population and economy does matter. Even with average or below-average levels of household and corporate debt, total U.S. bond debt (which includes much securitized household debt) accounted for 39 percent of global bond market value in 2017.8 Getting the mechanisms precisely right matters for policy that aims at faster growth rates, particularly as the long history of capitalism suggests that some degree of financialization is absolutely critical for growth.

So while there may be some truth to the argument that household debt substitutes for investment, the growth, investment, and household debt data don’t really line up in the expected way, unless we take a “quantity has a quality of its own” point of view. Here the much larger size of the U.S. population and economy does matter. Even with average or below-average levels of household and corporate debt, total U.S. bond debt (which includes much securitized household debt) accounted for 39 percent of global bond market value in 2017.8 Getting the mechanisms precisely right matters for policy that aims at faster growth rates, particularly as the long history of capitalism suggests that some degree of financialization is absolutely critical for growth.

Follow the Money

Financialization arguments advance both demand-side and supply-side mechanisms for slower U.S. growth after the 1970s. Both arguments rest on the diversion of NFC profits into the hands of financial firms. Under pressure from “shareholders”—read Wall Street—NFCs have shifted from what William Lazonick has called a “retain and reinvest” model of corporate behavior to a “downsize and distribute” model.9 Lazonick’s titles—“Profits without Prosperity”—and subtitles—“Predatory value extraction, slowing productivity, and the vanishing American middle class”—convey much of the argument. Before the 1980s, firms retained profits and continuously invested them in new products and process improvements, though Lazonick overlooks the contemporaneous conglomerate empire building and profound technological stagnation in the automobile sector. Today, firms shrink their physical capital and labor footprints to cut costs, and then distribute the additional profit to shareholders. The shareholder value model thus crippled firms’ ability to invest for growth.

In principle, draining profits from NFCs through large dividend payouts and share buybacks should promote an efficient use of capital in the larger economy. The economically rational shareholders receiving payouts from torpid firms should reinvest them into other firms capable of faster productivity growth and expansion. But data show precisely the opposite. Dividend payouts and buybacks have risen considerably as a share of profits from the 1990s to the present, but net fixed investment—a major contributor to both GDP and productivity growth—has fallen by nearly half from the 1980s to the 2000s. The 461 firms that managed to stay in the S&P 500 from 2007 to 2016 spent more than half their net income on share buybacks and a further two-fifths on dividends, retaining only 6 percent for reinvestment.10 Instead of productive investment, the cash from dividend payouts and share buybacks has flowed into the purchase of various sorts of positional goods—prime properties, artwork, etc.—and into existing financial assets. The prices for these kinds of assets have rocketed up since the 1990s.

But the aggregate picture conceals the important issue of which American firms actually capture profit. Here the usual story starts to break down. While financial firms in general have increased their share of total U.S. profits, firms whose profitability rests on intellectual property rights (IPRs)—patents, copyrights, brands, trademarks—lately have been capturing as much or more of total profit. Moreover, a handful of financial firms account for the bulk of profits, suggesting that the sector is not uniformly powerful. In the 2010 to 2018 period, the top ten financial firms accounted for two-thirds of the sector’s profits.

Figure 4 shows four important trends for U.S. publicly listed firms. First, the increasing concentration of businesses, as the number of publicly listed firms falls by 40 percent. Second, the increasing and highly unequal distribution of profit across those firms, with the top 1 or 2 percent of firms in any given decade capturing roughly half of all cumulative profits for that decade. Some of this increase simply reflects aggregation—the top 200 represent a rising share of all firms by headcount. But some also reflects an actual shift of profit from the bottom 98 percent to the top 2 percent that mirrors the parallel trend in U.S. household incomes. For example, the top ten financial firms increased their share of overall profits by 3.7 percentage points even as all financial firms in the top 200 only increased their share by 1.5 percentage points, indicating a drastic drop for those outside the top ten.

Third, the shift from the old “Fordist” complex of oil, automobiles, and assembly line manufacturing toward both finance and the IPR sectors is visible, despite occasional episodes of high profitability for the oil industry.

Fourth, significantly, the IPR sectors already outpaced finance before the 2008 crisis and widened their lead after that. The IPR sectors account for almost half of the 8.6 percentage point increase in the top 200 share. And while finance expanded its overall share, most of that was not the “private sector.” The two federally owned housing giants, Fannie Mae and Freddie Mac (GSEs), account for more than the entire increase in the financial sector’s profit share over the past three decades, reflecting the increase in mortgage debt from $4 trillion in 1992 to $15.4 trillion in 2018.

Likewise, the expanded share of the “rest”—a mixture of retail, communications, transportation, and health care firms—is also highly concentrated. Walmart alone accounted for more than a fourth of the 4.2 percentage point increase.

The stock market, the ultimate arbiter of what is good and true in modern society, confirms the massive shift in profitability and expectations of profitability in the relative capitalization of IPR-based firms as compared with finance or the rest. In August 2021, the top five IPR firms by market capitalization—Microsoft, Apple, Amazon, Alphabet (Google), and Facebook—represented 22.3 percent of the S&P 500’s total market capitalization, while the top five financial firms—JPMorgan, Visa, PayPal, Mastercard, and Bank of America—represented only 4.9 percent, a rather pessimistic assessment of future profitability.11 All told, IPR-based firms accounted for roughly 45 percent of S&P 500 market capitalization.

So the simple financialization story has two conflicting propositions. First, the core financialization story—that finance siphons the bulk of profits into households or firms that chase positional goods—appears to be true insofar as growth from 1992 forward has underperformed earlier decades. This story also appears to make sense because the magnitudes seem reasonably correct. The flow of profit diverted to financial firms has to be big enough to affect the macroeconomy for the financialization story to pass muster. A shift of nearly 12 percent of total profit should have some significant macroeconomic effect. Yet as figure 4 shows, this profit is not uniformly distributed across either financial or IPR-based firms. Moreover, if the shift of this volume of profit to a small set of financial firms is problematic, then the shift of profit toward an equally small set of low-employee-headcount IPR firms, which in the aggregate do little capital investment, should also be problematic.12 Financial and IPR-based firms account for nearly half of the top 200 firms. But even within those ninety-eight firms, profit is distributed unequally, with the top ten firms in each group accounting for 18.8 percent of cumulative profit of all listed U.S. firms, and half the combined share of both groups.

The Core Similarities of Finance and IPR-Based Firms

The key divide is thus not between financial firms and NFCs, but rather between a set of firms whose disproportionate profits rest on the possession of various IPRs, including a small set of financial firms that resemble IPR-based firms, and non-IPR based firms. High-profit finance and IPR-based firms, particularly tech firms, are converging and increasingly codependent at the level of business models and production processes—that is, how firms capture profit and what they do with that profit. These sectors exhibit four homologies, detailed below: splitting standardized goods into an intellectual property component they control and a generic good or service with low barriers to entry spun off to someone else; the salience of patenting specifically, and state sanctioned monopoly more generally, in creating a tollbooth around that intellectual property; the nature of production processes; and reliance on proprietary data collection and manipulation.

High-profit finance is increasingly a software and ICT business. It increasingly relies on patenting derivatives, business process software, and branded indices and exchange-traded funds (ETFs) to protect its margins, along with high frequency trading, algorithmic trading, and other software- and hardware-intensive activity. In reverse, the big tech firms themselves increasingly resemble financial firms on account of their large retained earnings and their intrusion into the payments and investment space through financial technologies (“fintech”). App-based or mobile payment services like Apple Pay, Google Pay, and PayPal’s Venmo now account for nearly a third of U.S. commercial transactions. App-based investment services like Robinhood increasingly dominate the retail investment space. Finally, these firms are co-dependent: the big financial firms are a necessary conduit for IPR firms transforming cash profits into assets, and much of their profitability rests on merger and acquisition activity and IPOs by the tech industry. Finance deviates from IPR-based businesses broadly, though less so platform firms, only in one respect: bulge bracket financial firms operate something akin to the old mafia protection racket, where they sell insurance to firms, in the form of derivatives, to protect those firms against the very volatility that those same bulge bracket firms create through their speculative practices.

Patents, Standardization, and Deflation

Financial firms and IPR-based firms have the same strategies for avoiding the downward price pressure that characterizes competitive capitalism. Put simply, the more standardized a product is, the more easily buyers can replace any given seller and the lower the barriers to entry for new suppliers. Indeed, the big platform firms—Amazon, Google, Facebook, or Uber—are profoundly deflationary for other firms by making price discovery relatively frictionless. The former capture profit; the latter see their pricing power and profits evaporate. In financial markets, generic products—like S&P 500 index funds—yield only marginal profits (which can, however, add up to large amounts given the huge volumes of pension money flowing into those indices). Ill‑informed investors might opt for the industry average annual expense fee of 0.84 percent on a fund indexed against the entire U.S. stock market, but Vanguard offers the same product for a 0.04 percent expense fee and consequently has been continuously taking business away from other firms.

Patented and bespoke (and therefore opaque, confusing, and complicated) derivatives can stave off such deflationary pressure. The first financial product patent was issued in 1990 for electronic futures trading. The U.S. Supreme Court validated patenting of mathematical and business algorithms in State Street Bank v. Signature Financial (1998). State Street then patented its system for building an ETF out of other ETFs. The hugely successful SPDR (“Spider”—S&P Depository Receipts), one of the earliest ETFs, was involved in litigation that established patent protection for custom ETFs.13 Even Vanguard, possibly the most ethical of the various institutional investment firms, patented an ETF structured to avoid ongoing taxation of dividends and capital gains (though not at redemption). The U.S. Supreme Court slightly rolled back protection for these business process patents (which include financial product patents) in Alice Corp. v. CLS Bank International (2014).

Still, after State Street investment banks have increasingly relied on Class 705 business process patents to protect new derivatives and processes. In 2014, for example, Bank of America filed roughly the same number of successful U.S. patents as Novartis, Rolls Royce, or MIT. JPMorgan Chase filed as many as Genentech or Siemens in 2014 and as many as STMicroelectronics or the University of North Carolina in 2018. From 1969 through 2019, Bank of America obtained a total of 2,319 patents, JPMorgan Chase 814, Goldman Sachs 244, and Wells Fargo 226. As with tech and copyright firms, patent litigation is a way to reduce or eliminate competition.

Opaque, bespoke derivatives stave off deflation a second way. Because nonfinancial firms are constantly borrowing money to finance ongoing operations, because those firms frequently need to manage long‑term pension and health care liabilities, and because many of those firms now sell overseas, they all face risks from unexpected shifts in interest rates, rates of return, and exchange rates. Financial firms offer to mitigate the very risks that they create and magnify in those markets by selling insurance against that volatility to individuals, nonfinancial businesses, and, increasingly, each other. In the act of selling insurance, they create new financial instruments—derivatives—that in turn create new possibilities for gambling with other people’s money. Each new derivative creates the potential for speculation against that derivative, and thus amplifies market volatility. Much like the old mafias, haute finance offers protection against broken windows while buying hammers with client money.

But this quasi protection racket is built on the restriction of information. These derivatives would not be particularly profitable if any firm could construct them. Generic derivatives have very low margins, as a survey of basic commodities or S&P 500 futures or exchange rate hedges reveals. Rather, profits arise from the production of opaque, customized derivatives using massive ICT and software inputs. Investment banks argue that the creation of derivative instruments tailored to specific customers creates efficiency in the market. But bespoke derivatives are often opaque to the buyer of the derivative and, even more surprisingly, sometimes to the firm building the derivative. Opacity is deliberate—it prevents buyers from comparison shopping across different investment or commercial banks, and it hides the true cost and/or risks of a specific derivative. Although hand-tailored derivatives have little or no track record, as Anastasia Nesvetailova and Ronen Palan point out, this behavior is part of the corporate culture at banks like Goldman Sachs, where traders were told to “Find yourself sitting in a seat where your job is to trade any illiquid, opaque product with a three-letter acronym.”14 Opacity functions like a patent by preventing direct competition that might lower profit margins. Hedge funds similarly never disclose their trading strategies or algorithms to clients.

The Convergence of Finance and Tech in Production

Production processes constitute a third homology. Like the big IPR-based firms, the big institutional investment and financial services firms outsource a whole range of support activities in order to have relatively small employee head counts: BlackRock has about 16,000 employees, Vanguard about 18,000, Goldman about 40,000. Small teams with high human capital and an ICT-and-software-heavy production process generate intellectual property much as engineers in software or biotechnology. The big investment and commercial banks are so human-capital-heavy that the acronym POWS—Physicists on Wall Street, not prisoners of war—has entered the lexicon.15

The big banks have information technology expenditures approximating or exceeding those of major tech firms like Google and Amazon. IT expenditures were 19 percent of total operating costs for Google in 2018, for example, versus 21 percent on average for eighteen major European banks and between 17 and 25 percent for four major U.S. banks. And these expenditures are directly linked to their profitability. As JPMorgan noted in a 2019 analysis of banking, “the relatively higher profitability of US banks also means they have the ability to spend more on IT, compared to European Banks.”16 This investment is directed at using algorithmic trading, high frequency trading, and good old-fashioned front-running to harvest an additional slice of the massive financial flows now characterizing most economies. The U.S. financial sector on average accounted for 10 percent of annual investment in intellectual property from 2001 to 2017.17

Finally, financial data is both a source of the big data deployed by key tech firms and supplies grist for finance’s algorithmic mill. Homologous with the platform firms, finance’s production strategy involves locking in customers, generating subscription-style revenues through ongoing transactions rather than one-and-done transactions, and harvesting consumer information in order to target offers and perform price discrimination. Like social media and search, every digitized payment (e.g., through Visa or MasterCard) generates data about the purchaser: location, product preferences, repetition, etc. This data can be combined with other data to build exquisitely detailed profiles of individual consumer preferences, which can be sold to advertisers, and data about aggregate buying patterns, which can be sold to producers and retail firms. As with social media and search firms, consumers willingly do the work of generating this information for the big payments firms. Just as the essence of financialization is the transformation of as many income flows into tradable and securitizable assets, big tech transforms personal behavior and clicks into sellable data.

Tech Is Becoming Finance

On the other side, the big tech firms are increasingly acting like financial actors. Central banks now worry that their entry into the fintech space will not only displace traditional banks but also create new regulatory problems. Financial services currently generate 11 percent of the annual revenues of big tech firms via applications like Apple Pay or Google Wallet. With fintech firms now handling more than 40 percent of payments globally, the Bank for International Settlements worries that, “In some settings, such as the payment system, big techs have the potential to loom large very quickly as systemically relevant financial institutions.”18

The Economist magazine jested that Apple Computer should be renamed Apple Capital LLC, because of its $123 billion portfolio of corporate and sovereign securities (in 2019).19 In addition to simply acquiring the debt of other corporations and then using that debt to build derivatives, Apple operates as a financial firm in a more subtle way. It has begun financing its own suppliers through its $5 billion Advanced Manufacturing Fund. The fund extends suppliers credit to create manufacturing capacity related to Apple products. The most important of such investments are a cumulative $450 million advance to Corning for the production of Gorilla Glass for cellphones, and $390 million to Finisar for camera range-finding lasers built on semiconductor chips. In both cases, these investments—or loans (the details are proprietary)—went toward construction of new plant and equipment. Apple thus has taken on some of the characteristics of a financial holding company akin to those built by banking magnates like J. Pierpont Morgan Sr. Apple acts as the strategic center of what could be seen as a modern American version of the early Japanese zaibatsu (literally, “financial clique”) which grouped a range of more or less closely held firms around a financial core, and in which strategic direction and investment flowed from that financial core.

The Convergence of Finance and Tech in Capital Flows

Meanwhile, finance and the tech world are organically connected at the level of capital flows—most obviously through venture capital, but in many other ways as well. Tech IPOs have been among the largest capital raises in the past two decades. These IPOs, of course, are also how the venture capital slice of finance captures profit and exits its positions. Mergers and IPOs accounted for 32.3 and 18.5 percent of total investment bank fee revenue on average from 2011 through 2020.20 Tech IPOs, narrowly defined, were worth a cumulative $247 billion in 2020 dollars from 2000 to 2020.21 As investment banks typically charge up to a 7 percent commission, tech IPOs are a major revenue source. Tech firms also aggressively use mergers and acquisitions to preempt competition. For example, Microsoft and Alphabet (Google) have each acquired over two hundred other firms since their founding, while Apple has acquired a mere one hundred.

High-profit financial firms are also a conduit for other actors’ money. The outsized profits IPR firms capture need to be recycled in some form if they are not committed to productive investment. These funds compose a significant share of the funds translated into rising indebtedness for governments and households, given the inversion of the old pattern in which households lent to firms. Were Microsoft a country, its 2019 holdings of $104 billion in U.S. Treasuries would make it the seventeenth-largest holder in the world, just ahead of all Canadian‑domiciled holdings of U.S. Treasury debt; Alphabet’s $55 billion of Treasury debt would make it the twentieth-largest holder, just ahead of Sweden; Apple’s $30 billion would make it the thirty-second-largest holder, just behind all Australian-domiciled holdings. Of course, Apple’s corporate debt holding of $85 billion would make it the eleventh-largest holder in the world, just ahead of the Netherlands.22 All of these placements generate revenue for haute finance.

Blood Banks and Growth

As Joseph Schumpeter argued a century ago, a truly competitive capitalism would be a capitalism without enough profit to do more than replace the existing capital stock.23 Perfectly efficient, perfectly in equilibrium, yet perfectly lifeless. Growth required entrepreneurially created monopolies, and those in turn required new credit creation, via either loans or expanding stock market valuations, to divert resources into novel forms of production and to create demand for that new production. The financial system thus must be more than a simple pipeline moving savings to borrowers, and new monopolies cannot be simple accumulators of profit who fail to transform that profit into the vast expansion of production that Schumpeter saw as the engine of growth.

In this sense, Lazonick and other analysts of financialization are correct that finance accumulates profit without actively redirecting that profit into productive investment. Indeed, a strong argument could be made that investors are destroying capital by subsidizing firms like Uber in a search for extractive monopolies.24 But this is true only in the much narrower sense that both the high-profit-volume banks and the big institutional investors have become a barrier to innovation. Institutional investors have encouraged mergers into monopoly for the sake of monopoly profit without any corresponding innovation, and their substantial holdings in any given sector discourage competition.25 Volatility stemming from investment banks’ speculative activity likewise encourages defensive mergers.

In sum, the usual analyses of financialization miss the degree to which the high-profit financial firms have built IPR-based tollbooths similar to those constructed by the high-profit IPR firms. Lind is correct that too much of the U.S. economy operates on a tollbooth principle today. But in macroeconomics, quantity has a quality all its own, as Stalin allegedly said about the Red Army. Little tollbooths are like barnacles on the ship of growth, but the handful of firms operating extensive tollbooths are anchors and, in some cases, actual holes in the hull. Core financial firms and IPR-based firms capture a disproportionately high share of profit generated in the U.S. and global economies, but perform a disproportionately small share of investment. Instead, they pass those profits on to a narrow set of households that then pursue positional goods and existing assets rather than funding productive investment.

While the core IPR firms, particularly those in the “tech” space, have ramped up investment in the emerging post-Covid era, it remains to be seen if this burst of spending will be sustained. The emerging threat of stricter antitrust enforcement might motivate core IPR-based firms to demonstrate their social utility. Tighter regulation contained the growth of the core financial firms’ profits after 2010, while the federal government captured nearly $300 billion of that after 2012 through its ownership of Fannie Mae and Freddie Mac. Profitability for both sorts of firms ultimately rests on how the government regulates IPRs, the basis of their monopolies. IPRs are legal creatures whose duration and robustness are open to legislative and judicial modification. The current domestic political environment—two decades of stagnant income for the bottom 80 percent of households—and geopolitical environment—the need to contain a China whose economy seems to be growing much faster than the U.S. economy—suggests policymakers will be searching for growth-enhancing initiatives. Understanding precisely which big monopolies or tollbooths have been hindering growth is critical for developing sound policy.

This article originally appeared in American Affairs Volume V, Number 4 (Winter 2021): 3–18.

Notes

1 Julia La Roche, “

Lloyd Blankfein: It’s Going to Be ‘Very Hard’ to Disrupt Goldman Sachs because It’s So Heavily Regulated,”

Business Insider, May 20, 2015.

2 Franco Moretti, Signs Taken for Wonders: On the Sociology of Literary Forms (London: Verso, 1983).

3 Thorstein Veblen, The Theory of Business Enterprise (Clifton, N.J.: A. M. Kelley, 1904; 1975); Rudolf Hilferding, Finance Capital: A Study in the Latest Phase of Capitalist Development (London: Routledge 1910; 1981).

4 Matt Taibbi, “The Great American Bubble Machine,” Rolling Stone, April 5, 2010.

5 As always, exceptions exist: Twilight’s sparkly, domesticated vampires (savings and loan banks?) and I Am Legend’s vampire zombies, based on a 1950s book reflecting anti-communist fears.

6 Michael Lind, “The Politics of Tollbooth Capitalism,” American Affairs 5, no. 1 (Spring 2021): 82–89.

7 Herman Mark Schwartz, “Corporate Profit Strategies and U.S. Economic Stagnation,” American Affairs 4, no. 3 (Fall 2020): 3–19.

8 Sifma, 2021 Global Capital Markets Fact Book (New York: sifma, 2021), 44.

9 William Lazonick, “Profits without Prosperity,” Harvard Business Review 92, no. 9 (2014): 46–55; William Lazonick, “The New Normal Is ‘Maximizing Shareholder Value’: Predatory Value Extraction, Slowing Productivity, and the Vanishing American Middle Class,” International Journal of Political Economy 46, no. 4 (2017): 217–26.

10 Lazonick, International Journal of Political Economy, 221.

11 It’s telling that PayPal had a higher market capitalization than more traditional financial institutions like Wells Fargo, Morgan Stanley, or Citibank. PayPal had 277 successful patent applications in 2019. Including Berkshire Hathaway, a holding company involved in a wide range of sectors, and United Healthcare, which blends insurance and service delivery, as financial firms raises the top-five finance share to 5.7 percent.

12 Schwartz, “Corporate Profit Strategies.”

13 U.S. Patent No 6,088,685, “Open End Mutual Fund Securitization Process.”

14 Anastasia Nesvetailova and Ronen Palan, “Sabotage in the Financial System: Lessons from Veblen,” Business Horizons 56, no. 6 (2013): 727.

15 Jeremy Bernstein, Physicists on Wall Street and Other Essays on Science and Society (New York: Springer Science & Business Media, 2008).

16 Data and quote from Thomas Hale, “How Negative Rates Feed into the Technology Race,” Financial Times, September 19, 2019.

17 Bureau of Economic Analysis, Table 4.7-FAAt407-A, “Investment in Private Nonresidential Fixed Assets by Industry Group and Legal Form of Organization” (2018).

18 Bank for International Settlements, “Big Tech in Finance: Opportunities and Risks,” Annual Economic Report 2019 (Basel: Bank for International Settlements, 2019), 55–56; David Bassens, Reijer Hendrikse, and Michiel van Meeteren, “The Appleization of Finance: Reflections on the FinTech (R)evolution,” Financial Geography Working Paper no. 2 (Brussels: Vrije Universteit Brussels, 2017).

19 From Apple 2019 10-K, 41.

20 Sifma, 2021 Global Capital Markets Fact Book, 88.

21 Calculated from Jay Ritter data at https://site.warrington.ufl.edu/ritter/files/IPO-Statistics.pdf, 12.

22 Author calculations from U.S. Department of the Treasury, Treasury International Capital System at https://www.treasury.gov/resource-center/data‑chart-center/tic/Pages/shlreports.aspx, and the relevant firm’s SEC form 10-K.

23 Joseph Schumpeter, The Theory of Economic Development (Cambridge: Harvard University Press, 1934); the German original was published in 1911 and revised for the English translation.

24 Hubert Horan, “Uber’s Path of Destruction,” American Affairs 3, no. 2 (Summer 2019): 108–33.

25 José Azar, Martin C. Schmalz, and Isabel Tecu, “Anticompetitive Effects of Common Ownership,” Journal of Finance 73, no. 4 (August 2018): 1513–65.

Even at the peak of borrowing in 2006, U.S. households were less encumbered than many northern European households and at basically the same levels as allegedly un-financialized German and Japanese households. Indeed, U.S. households have saved more of their disposable income than Japanese households for the past fifteen years. Finally, U.S. corporate debt levels relative to GDP are also at the lower end of the larger OECD economies (figure 3).

Even at the peak of borrowing in 2006, U.S. households were less encumbered than many northern European households and at basically the same levels as allegedly un-financialized German and Japanese households. Indeed, U.S. households have saved more of their disposable income than Japanese households for the past fifteen years. Finally, U.S. corporate debt levels relative to GDP are also at the lower end of the larger OECD economies (figure 3).  So while there may be some truth to the argument that household debt substitutes for investment, the growth, investment, and household debt data don’t really line up in the expected way, unless we take a “quantity has a quality of its own” point of view. Here the much larger size of the U.S. population and economy does matter. Even with average or below-average levels of household and corporate debt, total U.S. bond debt (which includes much securitized household debt) accounted for 39 percent of global bond market value in 2017.

So while there may be some truth to the argument that household debt substitutes for investment, the growth, investment, and household debt data don’t really line up in the expected way, unless we take a “quantity has a quality of its own” point of view. Here the much larger size of the U.S. population and economy does matter. Even with average or below-average levels of household and corporate debt, total U.S. bond debt (which includes much securitized household debt) accounted for 39 percent of global bond market value in 2017.