In 1930, John Maynard Keynes imagined the end of capitalism, which he predicted would arrive about a hundred years into the future:

The love of money as a possession—as distinguished from the love of money as a means to the enjoyments and realities of life—will be recognised for what it is, a somewhat disgusting morbidity, one of those semi-criminal, semi-pathological propensities which one hands over with a shudder to the specialists in mental disease. . . . There will be ever larger and larger classes and groups of people from whom problems of economic necessity have been practically removed.1

It has not turned out that way. And yet, this last year has witnessed an astonishing turnabout from the recent past, in which scholars and pundits generally accepted the “End of History” conclusion that liberal capitalism had firmly established itself as the stable order toward which the arc of economic history bends. In its first issue of the new decade, Foreign Affairs pondered “The Future of Capitalism” and particularly the impact of inequality on that future. In its lead article, Branko Milanović raised the possibility that the democratizing role of global capitalism is fading, replaced by competition between a resurgent national capitalism and a state capitalism characterized by central planning and reduced personal and political freedom.2 This point was further developed in Nicholas Lemann’s review of The Meritocracy Trap in the same issue.3 For its part, American Affairs’s final issue of 2019 included a collection of articles under the heading “Feudalism, Capitalism, and Socialism” that covered similar ground. Joel Kotkin documented how the ultrarich’s share of property ownership looks a lot like what “anchored both the medieval aristocratic and ecclesiastical classes.”4 Julius Krein provocatively suggested that even well-compensated professional and technocratic elites have been proletarianized by the oligarchs of the top 0.1 percent.5 In a recent profile in the MIT Technology Review, even Robert Solow, who received a Nobel Prize for his work measuring the effects of technology on productivity, openly scorns the supposed wisdom of “free markets,” asserting instead that “new policies are needed to rebuild a healthy middle class, including better workers’ representation in firms and a tax code that benefits labor. . . . Our policies, not just our technologies, are dramatically affecting work, careers, and income inequality.”6 Once seen as uniquely dynamic, Western capitalism has come to be seen instead as exhausted and even illegitimate.7

All of these articles pondering the state of our economic system trail by four years a provocative—if lightly read—book by the German sociologist and political economist Wolfgang Streeck. He posited that the lack of coherent opposition to a failing, “sclerotic” capitalism had created a void in which there was nothing but a dilapidated, neo-feudalist social order characterized by oligarchic corruption and dwindling public purpose.8 Today, signs of this ugly new model’s emergence are visible nearly everywhere.

This article is part diagnosis, part prognosis, and part prescription. As nonacademic research economists from the financial sector and the labor movement, we are skeptical that a recognizably democratic capitalism can withstand the assault both from the ascendant neo-feudal oligarchy model elucidated by Streeck and from the explicitly statist, centrally planned Chinese model. (As for oligarchy, it is not really as new as it seems in America: its long history was arguably interrupted only briefly in the 1933–80 period, during which the nation moved haltingly toward social democracy.9) We argue that the new feudal model will be principally characterized by the conflict between preserving wealth and funding future economic growth, and we examine how its emphasis on the former discourages entrepreneurship and will likely lead to poor economic performance. Finally, we discuss some more egalitarian alternatives.

Why China Wins

We begin with our conclusion: China has surpassed or will soon surpass the United States in many key dimensions, including economic growth, health care, education, 5G network rollout, and the development of artificial intelligence. Today, 103 years after the Russian Revolution, central planning can finally be effective and strategic, thanks to the volume of available data and—even more important—the models and algorithms available to make sense of those data. Data‑dependent algorithms today schedule buses and trains, select medication based on patients’ genetic markers, set time-of-day electricity prices, and much more. No less liberal and market-oriented an authority than the editorial staff of the Economist has admitted that Big Data may well have changed the prognosis for “socialism”:

The operations room of “Project Cybersyn” (short for “cybernetics synergy”) was created by Chile’s president Salvador Allende in the early 1970s as a place from which the country’s newly nationalised and socialised economy could be directed. . . . Allende had thought that, with state-of-the-art 1970s communications and computers, it would be possible for government to optimise an industrial economy. . . . The success of market- and semi-market-based economies since then has made the notion of a planned economy seem like a thing of the past. But were a latter-day Allende to build a Cybersyn 2.0 it could now gather data via billions of sensors rather than a few telex machines, and crunch them in data centres with tens of thousands of servers. Given enough power, might it not replace the autonomous choices on which the market is based?10

But the ability to plan effectively is not enough. In addition, as Keynes noted frequently, there must be a coherent set of goals, a destination that is understood and—whether through mass support or coercion—economic actors marching toward them. From these goals and their broad support comes China’s track record of launching new homegrown industries. Consider electric vehicles (EVs). Forecasts project such vehicles will account for 15–20 percent of all cars and trucks sold in the United States in 2030; in China, they will make up 80–100 percent.11 Why? Quite simply, because the Chinese government requires it. The state can set fuel prices at levels that will make EVs desirable, mandate their production, guarantee a nationwide charging infrastructure, and force regional authorities to ban non-EVs from streets and roads.

Nor are EVs an isolated case. The hybrid command economy has already achieved equally dramatic breakthroughs in energy extraction, power generation, solar cells, aerospace engineering, and the construction of shipping ports and dams throughout China. And it increasingly extends these achievements across much of Asia and Africa, where China is making state-directed or state-catalyzed investments on a scale the United States has not even attempted since World War II. Not only, as we discuss below, do China’s continuing public investments dwarf those of the United States and the European Union relative to the size of their economies; this investment is also guided by a unified strategy that aims at increasing the living standards of its people by ensuring that China dominates the key technologies of the future. Literally thousands of investments and de facto loan guarantees are made each year, creating whole new cities that specialize in particular technologies.

The scale of China’s investment is staggering. In 1970 gross capital formation was 21.4 percent of GDP in the United States and 25 percent in China. In 2018 it was 21 percent in the United States but 44 percent in China. About one-third of China’s 2018 capital stock was due to direct government investments, but two-thirds was private investment.12 The unchallenged power of the central state to make, guide, and catalyze those investments is a huge advantage. China can also mobilize resources quickly: earlier this year, it built a thousand-bed hospital in which to quarantine and treat coronavirus victims in Wuhan—in just six days.13 In the United States, that would be an impossibly tight schedule even for getting a building permit.

The state can command both state-owned companies and private, profit-motivated ones to undertake major expansions, and those companies can enjoy full confidence that the additional production capacity will be put to use. Of course private construction companies run by Communist Party members have an advantage, but this comes at little or no cost to the efficiency of the projects on which their companies work. In the West, greater political freedom often manifests itself as the freedom to block an investment from ever being made or to run up its price. If Chinese businesses must play nice with the local or regional Communist Party, Western businesses must play the same game with lenders, insurers, and regulators, not to mention politicians. If they are in large-scale real estate development in big cities, they often must get along with more clandestine players, sometimes tapping the laundered funds of foreign oligarchs to avoid relying too much on the regulated financial sector.

In the United States, public investment almost always collides with private interest. Elite-dominated “civic” organizations raise nimby objections to both public and private investments, even if they promise social benefits. For example, millionaire Nantucket homeowners banded together to kill an offshore wind farm that would have blocked their pristine ocean views. The projects that do go forward take years to execute and nearly always cost significantly more than their initial estimates. For example, the new Freedom Tower at One World Trade Center cost $4 billion and took eight years from the first day of construction to the first tenant’s occupancy, both twice the initial estimate.14 The additional costs generated by the litigious culture of Western societies (especially of the United States) also constitute a serious barrier to any substantive new development. Private developers therefore work hard to capture local government in order to reduce these costs. Worse, what little public investment is made here is not tied to any particular set of strategic goals, but at best aims at providing minor economic stimulus through a few “shovel-ready” projects.

Tolerating Failures: The State as Macro-Scale Venture Capitalist

Of course, even with the full backing of the state, some of China’s big public investments don’t pan out. In the United States, however, every visible government investment is subject to being tagged as the next Solyndra and held up as proof of government’s incompetence and the market’s superiority. In China, on the other hand, such failures are understood as the inevitable (and quite minor) downside of a largely successful strategy that has yielded 5–13 percent annual GDP growth for three decades and has provided its people with affordable shelter, education, medical care, sanitation, and world-class trains and public transportation.

In three short decades (1988–2018), China’s real per capita GDP has risen 700 percent from barely $1,000 to about $8,000. For the world as a whole, real per capita GDP grew from roughly $7,000 to just under $11,000, or 57 percent in the same period.16 If China is excluded from the global numbers, the increase in the rest of the world was from $8,180 per capita to $11,350, or just 38 percent. And in the West, a significant percentage of that relatively paltry growth went to the top 1 percent and especially the top 0.1 percent.

Of course, China’s 700 percent increase in real per capita GDP began from a low base and has had multiple drivers, among them burgeoning net exports to the West and, no doubt, an ample amount of intellectual property theft. But no reasonable analyst can ignore the catalytic role of huge public investments. Imagine what American infrastructure, education, R&D, and productivity would look like if our federal government had invested even half as heavily as China did during the last thirty years. We in the United States—and, increasingly, in many other Western nations as well—don’t build transit systems and other infrastructure at anywhere near pre-1980 rates. We don’t even keep up on the maintenance of roads, bridges, dams, sewer systems, or water treatment plants. We look more and more like the Third World, sharing their high Gini coefficients and allowing a relative handful of rich people to prosper even as the underpinnings of majority living standards are allowed to erode. By leaving almost all investment decisions to private actors, we fail to mobilize the wealth already in hand, which was a major fear of Keynes. Warren Buffett’s Berkshire Hathaway sits on $128 billion because it cannot find any companies to buy at bargain-basement prices. Nor is Buffett the exception: nonfinancial corporations in the United States are sitting on roughly $3 trillion in cash.17

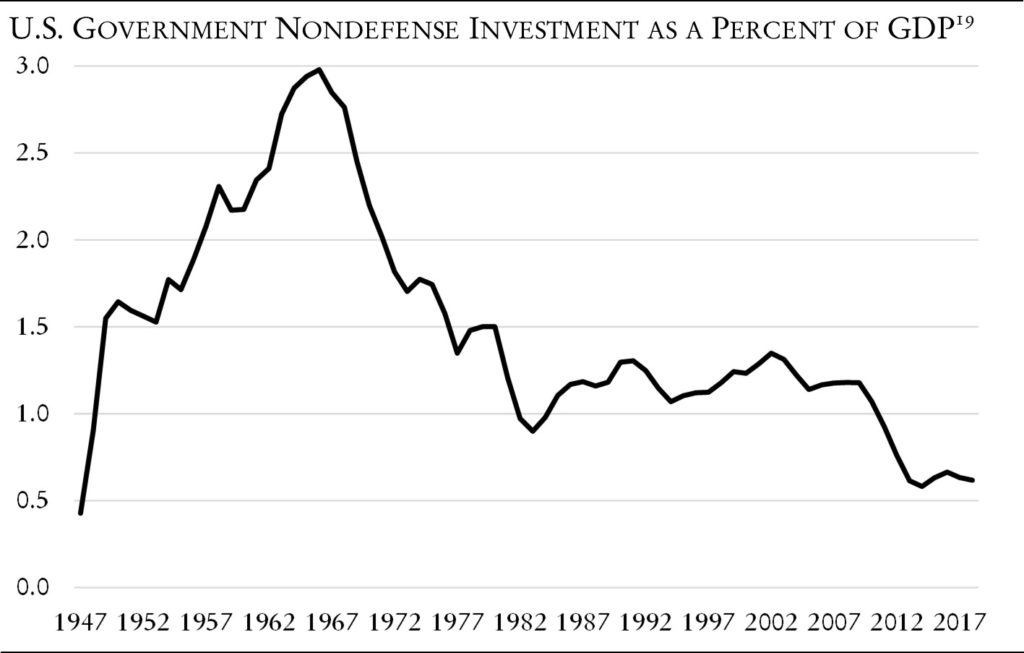

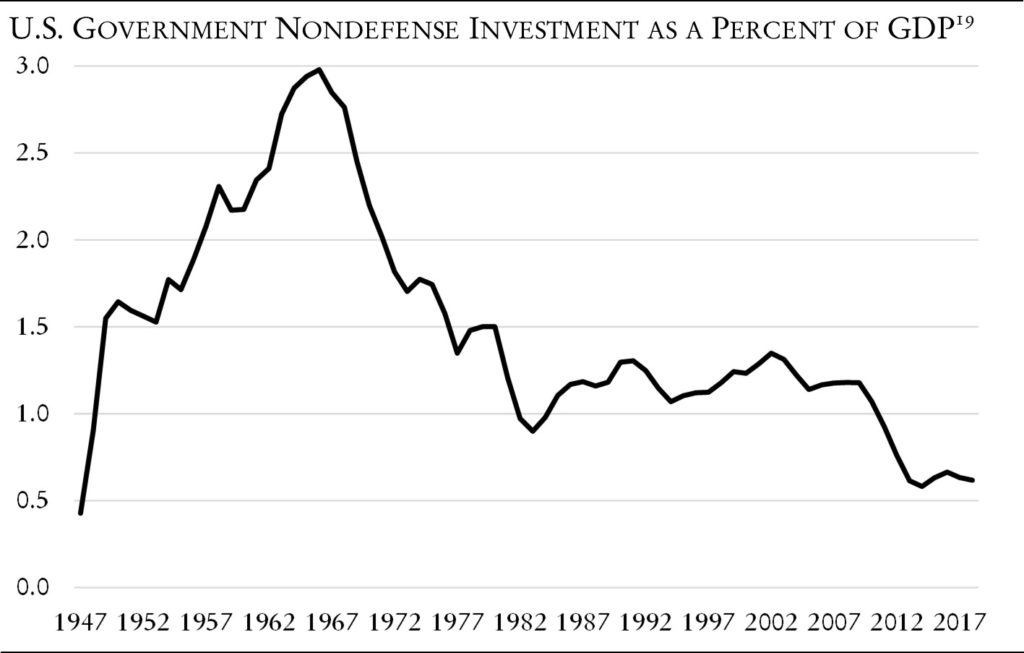

Except for military procurement, the U.S. government has been AWOL from the productive economy since the mid-1970s, when the nation’s last full-blown transit systems, California’s Bay Area Rapid Transit system and the D.C. Metro, opened. Between 2010 and 2015, China’s average annual infrastructure investments came to $1.15 trillion or 8.3 percent of GDP. For the United States in the same period, such investments averaged just $483 billion or 2.3 percent of GDP.18 If we look beyond infrastructure spending to all nondefense federal government investment, the trend is even worse: it has fallen by two-thirds since the mid-1960s and by half since just 2002.

Nor is there any reasonable prospect of this changing soon. Except in the military economy, the crucial government functions required for monitoring and guiding policy have been massively hollowed out. Even the Washington office buildings in which they were long housed are now mainly occupied by lobbying firms, law firms, corporate government relations offices, and partisan think tanks. Many of these, to be sure, are reputable operations; but most are either servants of oligarchy or defenders of rent-seeking professionals.

Oligarchy Trumps Liberal Capitalism

The core of the problem is the accelerating ability of the richest 0.1 percent of American families to claim most of the economy’s increasingly meager growth. In the United States, and increasingly across the European Union as well, the ultrarich possess more and more of the total wealth and of both pre- and post-tax income. This is problematic, as we will show, because as a group they are “investing” their burgeoning wealth in ways that fail to spur growth and employment. As a result, all but a relative handful of oligopolies and larger companies—mainly the faangs (Facebook, Amazon, Apple, Netflix, and Google)—find themselves starved for affordable capital and forced, if they can borrow at all, to pay near-double-digit rates or even give up equity, at a time when official interest rates are at record lows. For lenders, it comes down to risk and reward, and a shift toward higher-yielding private credit markets, as opposed to traditional commercial lending, driven by the wealthiest investors.20

The owners and managers of big American oligopolies may claim to be personally appalled by the violation of liberal norms on the part of populists like Donald Trump and Jair Bolsonaro. But they are hardly demanding a more egalitarian social contract or taking steps to address the social and economic conditions that give rise to populism. Instead, they are resolutely resisting trade unions (spending $340 million on union avoidance in 2018 in the United States alone)21 and capturing what used to be labor income at record rates, even as they lament tariffs that add uncertainty to global trade. The U.S. model emphasizes tax cuts, the gutting of regulations and safety-net programs, and ceaseless, if groundless, warnings about the coming insolvency of “entitlements.” Most big U.S. companies are spending the bulk of their recent trillion-dollar tax cut not on new investment but instead on stock buybacks. Following the tax law passed in late 2017, U.S. companies set a record by using the windfall to repurchase $1.09 trillion of their shares in 2018. They followed that up with the second-biggest buyback ever the following year, spending an additional $900 billion and further driving up share prices.22 Since the bottom 50 percent of the income distribution does not even own stocks and the top 10 percent owns 84 percent of tradable shares of U.S.-based companies,23 this nonproductive corporate behavior drives financial market bubbles that generate yet more inequality.

Financing Inequality: Preserving Wealth versus Funding Growth

Until the 1980s there was a reasonably robust set of pathways for wealth to make its way into the U.S. economy. In the 1990s, however, a great consolidation began. According to the Securities and Exchange Commission, in 1987 there were fully ten thousand broker-dealers, groups of professionals seeking out opportunities—some proven, some less mature but more exciting—to invest the money under their management. Today, by contrast, there are likely fewer than 3,900 broker-dealers.24 This consolidation in wealth management has been amplified by the appearance and growth of index funds in recent years. According to Bloomberg Businessweek, the portfolios of the three biggest indexing companies (BlackRock, Vanguard, and State Street) hold about 22 percent of the shares of the typical S&P 500 corporation.25 To be clear, the “investments” made by such companies are simply bets about the level of the S&P and other indices; they do not provide capital to the actual companies whose share prices make up the index. “As millions of investors have done the most sensible thing financially,” Bloomberg notes, “they’ve also concentrated shareholder power,” generating concern about capital concentration and its harm to consumers and workers.26

Smaller banks, once a crucial source of capital for subnational businesses, have been badly squeezed: the number of commercial depository banks in the United States plunged from 14,400 in 1984 to fewer than 4,600 in mid-2019.27 Private credit is supplanting depository institutions, and private equity is playing a significant role in taking companies out of public markets and concentrating their ownership in private hands. Unlike the core financial services industry of the pre-1980s period, private managers typically do not broadly survey the economy for start-ups and growth companies. Instead they only bet on a small slice of the nation’s companies (contributing greatly to the overvaluation of the faang corporations) and spend most of their time making speculative trades trying to beat the S&P’s yields through shorting, arbitrage, financial engineering, and participation in direct lending activities—the so-called shadow credit market, where rates are often two to three times the major banks’ rates.28

Private equity and private credit funds are not the only cause of the disintermediation of the past few decades, nor are they the only culprits in the development of a financial services industry that is failing to mobilize wealth for the benefit of the broader economy. As the rich get richer, more and more of them see little reason to pay large fees to brokerage houses or to hedge, credit, and equity fund managers. Instead, they are opening family offices, in which a relative handful of managers working on behalf of ultra-high-net-worth families look for a small number of deals into which to put a few billion dollars at a time. Such family offices now run upwards of $9 trillion. Compared to pre-1980s Wall Street, these offices do not have a deep bench of analysts scouring dozens of economic sectors; instead, even more than hedge funds, they focus primarily on safe bets, typically trading in a narrow set of blue chip bonds and equities. At the same time, they are leading the shift of more capital out of public markets. So-called direct investments now account for approximately 40 percent of total family office investments, a proportion that is expected to grow as funds shift out of public securities and into higher-yielding, less-liquid assets. Coinvestment deals involving multiple rich families are becoming more popular, which will move even more wealth out of the broader capital markets.29

This should come as no surprise; these family offices’ charge, after all, is not to expand the economy but to preserve the wealth of their rich investors. It is equally unsurprising that one of the things at which some family offices are quite skilled is placing money offshore. As more and more wealth resides in fewer and fewer hands, the central purpose of “investment” changes from looking for ways to grow the economy to trying to preserve stocks of wealth that are already as large as their owners will ever need. With interest rates negative in much of Europe, the flight from risky investments is taking on some bizarre forms: in Switzerland, some billionaires reportedly are moving cash out of bank accounts paying –0.75 percent per year and into home safes in hardened rooms and other proverbial mattresses.30

Starving the Innovators

The firms that dominate Wall Street today (JPMorgan Chase, Bank of America, Citibank, Goldman Sachs, Morgan Stanley, BlackRock, Vanguard, and Fidelity) have consolidated the financial services industry into what amounts to a capital-hoarding oligopoly. As a result of their tremendous size, their corresponding need for operating leverage, and the increase in risk-adjusted capital requirements for the banking business, these firms can no longer afford to service those far below the top 0.1 percent who need a place to put their savings; instead they have to “reinvent banking” for the ordinary investor and saver through financial technology and other automated services. This consolidation of financial institutions is now in its third decade, with traditional Wall Street also bleeding jobs due to consolidation, disintermediation, and the “reinvention” of banking. Allana Akhtar recently predicted in Business Insider that “the 2020s could be an apocalyptic decade for Wall Street as artificial intelligence takes over the most popular jobs in finance. . . . Jobs in banking are some of the most sought-after for job seekers—but plenty of roles may not be around much longer. Algorithms that model prices or build portfolios could wipe out six million high-paying jobs in finance.” She notes the warning of Cornell professor Marcos Lopez de Prado, who recently told the U.S. House Committee on Financial Services that, while artificial intelligence might not replace jobs entirely, few current finance employees are trained to work alongside new technology. His testimony aligns with a 2019 IHS Markit Report which forecast that 1.3 million U.S. finance jobs—particularly among stockbrokers, fund managers, and compliance and loan officers—could disappear by 2030.31 The Brookings Institution found that white‑collar employees in tech and finance are “more susceptible to AI job loss than social workers, teachers, or cooks.”32

For the U.S. economy this implosion of diversified investment and broad lending, and its replacement by a burgeoning sector focused on very specific investment opportunities and mere wealth preservation, is quite disastrous for smaller firms and, crucially, for new ones. Consider the following developments33: (1) New businesses represent a declining share of total businesses. According to U.S. Census data, new firms represented as much as 16 percent of all firms in the late 1970s. By 2011, that share had declined to 8 percent.34 (2) Not only are there fewer new firms, but those start-ups that do exist are creating fewer jobs. The gross number of jobs created by new firms has fallen by more than two million.35(3) Start-up activity has been subdued across the country since the Great Recession. Firm entry rates were lower between 2009 and 2011 than they were between 1978 and 1980 in every state and in all but one Metropolitan Statistical Area.36

All but the largest firms are starved for funds or forced to pay exorbitant rates to borrow. As younger, smaller firms stagnate and fail, favored oligopolies and larger companies—which had access to vast pools of capital when they were young and dynamic—get bigger and bigger, yet less and less innovative, hoarding cash and buying out potential competitors. These developments in the financial services sector since the early 1990s have starved American innovation, denying needed funds both to the innovators and to the entrepreneurs that commercialize their inventions and thereby create jobs.

Timing Is Everything: China’s Superior Model

The resulting system is not only growth-inefficient for the private sector but also data-inefficient for both the private and public sectors. Amazon, having bought Whole Foods, plans a few fully automated grocery stores; in China, however, nearly all transactions at all stores flow through the newly allied Alibaba and TikTok apps on consumers’ handheld devices. This data-driven economy permits central capture of every detail of supply and demand, including the time it took for a given consumer to reach the store on a bus or train (since the same device also holds data from transit ticket purchases). Not only is the data “big”; it is also complete and—crucially, if perhaps worrisomely—fully visible to the state for planning purposes.

Armed with coherent goals, comprehensive data, and powerful analytical tools, the Chinese state has put Keynes on steroids, investing massively to dominate a global future of clean energy, electric cars, aircraft, facial recognition, 5G and 6G telecommunications, and the broad application of artificial intelligence. U.S. trade negotiators demand that China abandon its industrial policy and subsidies, and scale back its ambitions to dominate high-end manufacturing and high-tech industries. But these demands are patently laughable, amounting to an inept, profligate also-ran demanding concessions from a risk‑taking victor, the first nation-state to possess enough data—and to have developed the necessary analytical tools—to make central planning succeed.37

Kai-Fu Lee has catalogued the incredible advances China has made and the competitive advantages it enjoys in Big Data, the fuel for machine learning and artificial intelligence, through its culture of near‑universal online access and centralized purchasing technology.38 Nor does the Chinese government’s strategy for mobilizing and directing investment require much political coercion; it apparently enjoys broad support in a nation with strong collectivist underpinnings. And—while this remains a subject worthy of further study—it is not inconsequential that China, unlike the United States, does not use up capital on external wars and has a military budget that, in relation to GDP, is half the size of ours.39 One should not draw overly deterministic conclusions from this situation: other forces, as Solow observes, are at work and shape technological change. It is simply the case that China makes more of its wealth available for innovation.

At the moment, however, the future is not seriously in doubt. Public investment drives productivity, which—unless the gains are overwhelmingly appropriated by the rich, as they are in the United States—lifts wages, which in turn legitimizes the government and supports national consensus rather than extreme partisanship. Western capitalists, by remaining silent and therefore complicit in capitalism’s slide into mere wealth preservation, have more or less ensured the system’s self-destruction, gutting its legitimacy and dodging the taxes required to finance the extension or even the reproduction of its infrastructure. Everywhere in the West, mobile private capital has held the public realm hostage, starving it of the capital needed to sustain itself while simultaneously demanding ever-larger subsidies.40

In every Western capitalist nation, the rich are pulling away from the rest of the public, albeit at somewhat different rates from country to country. Rising inequality—in incomes, in wealth, in access to health care, and even in the exercise of rights—is represented as a natural process that, however regrettable, is better than socialism. Economists chalk it up to the skills that working people were too lazy or too self-indulgent to acquire, but are largely silent on the pernicious effects of shadow markets, anticompetitive concentration of ownership, hedge fund tax breaks, and corporate and family office hoarding of existing wealth. These, along with rampant tax evasion, permit the very rich to prosper ever more while the majority struggles to stretch still-1970s-sized paychecks until the next Friday.

What Might Be Done?

While the wealth of the rich keeps growing—as if by magic, but really through the particular evolution of the financial markets and the forbearance of the regulatory state—the original and continuing source of this growth has been the rich’s capture of more or less all productivity gains since 1980. Prior to that, 60 percent of those gains typically went to labor.41

Thus, doing something about pretax incomes is the logical starting point. In this context, large increases in the minimum wage and its extension to occupations now exempt from it would be all to the good. So too would be sharply more progressive income and/or wealth taxes, though these would matter less if the pretax income distribution could be improved.42 And philanthropy, which depends on the largesse of the very rich, is by itself no substitute for an activist state. That’s why, even among business elites—for example, in the Salesforce.com CEO’s speech at Davos 2020—there is talk of an imminent “tipping point” toward crisis absent progress away from “short-termism” and “for shareholders only” and toward some version of “stakeholder capitalism.”43

But such initiatives presuppose a significant shift in political power away from oligarchs and the very rich to the majority. With the former more or less firmly in charge both economically and politically, that is a tall order—especially when half of the poorest 99 percent of the U.S. population still votes for the party that purports to support a smaller, less intrusive government.

Not that it is not, in principle, easy to conjure up an ambitious prescription. In the postwar years, U.S. taxpayers were the early-stage “venture capitalists” that provided financing for the Space Race and, later, for the Defense Advanced Research Projects Agency (darpa), the central research and development organization for the U.S. Department of Defense. Darpa is widely credited with having created the internet, without which Amazon, Facebook, Google, and Netflix would not exist. Were the public and the state to take and retain lasting ownership, immune from both share dilution and future privatization—of even 20 percent of the shares in these four companies (and, logically, in Apple, Cisco, GoDaddy, Microsoft, Oracle and other major technology firms), that equity could fully fund a broader social safety net. (Indeed, this is what conventional taxation is supposed to achieve, but in an era of widespread tax arbitrage, perhaps it makes more sense for states to simply appropriate equity stakes.) It would make Andrew Yang’s proposed $1,000 monthly stipend to each adult seem modest indeed. It would be an enduring form of redistribution and a far better way to grow the economy than letting the income flow into the pockets of the few. This would, ironically, be capitalism at its core, with risks and rewards flowing to the “cowboy money” that finances basic R&D and the venture capital to which profits are returned irregularly but also spectacularly. Such ownership should less resemble an individual stake like in an employee stock ownership plan; instead, it should be a public stock ownership program that could help finance public goods in a late-stage or even postcapitalist society.

Even if such a fix cannot be achieved at present, history reminds us that long strides toward the seemingly impossible are sometimes just a few general strikes or mass protests—of the kind seen recently in the streets of Paris, Beirut, and even the United States—away from plausibility. That may be what it takes to generate public pressure for and elite acceptance of something more like the activist state of Franklin Roosevelt’s New Deal. This time, such a state would have a lot to learn from China about setting and realizing goals for increasing the public good, while also ensuring that the process remains underpinned by a far more robust democracy than the Chinese state allows. There is broad support for such a reactivated state, not least among the millions of young Americans who reject capitalism as it has come to be.

This article originally appeared in American Affairs Volume IV, Number 3 (Fall 2020): 84–98.

Notes

The authors wish to acknowledge James Zabala for his research assistance, as well as the Max Planck Institute for the Study of Societies in Köln, Germany, and the Institute for Research on Labor and Employment at the University of California, Los Angeles, for their support during the research. We also thank Gerald Brodsky, Jay Grusin, Wolfgang Streeck, Stefan Timmermans, and Tom Weisskopf for their comments and suggestions.

1 John Maynard Keynes, “Economic Possibilities for our Grandchildren (1930),” in Essays in Persuasion (London: MacMillan, 1931), 358–73. Keynes’s postcapitalist vision is usefully explored in Pascal Riche, “Keynes 2030,” Verso (blog), February 15, 2017. In the U.S., total income is sufficient to ratify Keynes’s forecast of a society in which further acquisitiveness would be unnecessary, with GDP of $64,000 per person and $161,000 per household; see “United States GDP,” Trading Economics, and United States Census Bureau, “Historical Households by Type: 1940 to Present,” United States Census Bureau Current Population Survey, November 2019. Yet in this apparently wealthy nation, more than 30 percent of households have no savings beyond their often meager equity in their residence and 40 percent could not handle a surprise $400 expense; see Sam Dogen, “The Percentage of People with No Wealth outside Their Home Is Sad,” Financial Samurai, January 16, 2018, and Annie Nova, “Many Americans Who Can’t Afford a $400 Emergency Blame Debt,” CNBC, July 21, 2019. Sky-high income inequality means that, amidst the aggregate plenty, a large majority of Americans live little better than they did a half century ago, with only a small minority enjoying the economy imagined by Lord Keynes ninety years ago.

2 Branko Milanović, “The Clash of Capitalisms: The Real Fight for the Global Economy’s Future,” Foreign Affairs 99, no. 1 (January–February 2020): 10–21.

3 Nicholas Lemann, “Unmerited: Inequality and the New Elite,” Foreign Affairs 99, no. 1 (January–February 2020): 140–47.

4 Joel Kotkin, “America’s Drift toward Feudalism,” American Affairs 3, no. 4 (Winter 2019): 96–107.

5 Julius Krein, “The Real Class War,” American Affairs 3, no. 4 (Winter 2019):

153–72.

6 See Peter Dizikes, “The Productive Career of Robert Solow,” MIT Technology Review, December 27, 2019.

7 See Gabriela Schulte, “Poll: 57 percent of Voters Say U.S. Political System Works Only for Insiders with Money & Power,” Hill, March 31, 2020.

8 See Wolfgang Streeck, How Will Capitalism End?: Essays on a Failing System (New York: Verso, 2016). Daniel Araya, “The Revolution After the Crisis,” Forbes, March 31, 2020, addresses Keynes’s prediction of how Western capitalism ends following the virtual closure of the economy due to the coronavirus pandemic and echoes Streeck’s conclusion about a new neo-feudalist political economy. His reconciliation of the two is unconvincing, but this speaks to the confusion around the current crisis of capitalism.

9 Craig Zabala and Daniel Luria, “New Gilded Age or Old Normal?,” American Affairs 3, no. 3 (Fall 2019): 18–37. As we noted there, oligarchy is problematic and far from new. Over a century ago, Theodore Roosevelt wrote, “of all forms of tyranny, the least attractive and the most vulgar is the tyranny of mere wealth, the tyranny of plutocracy” (Theodore Roosevelt, Theodore Roosevelt: An Autobiography [New York: MacMillan, 1913], 464). But vulgarity is not a death sentence. The rising inequality that enables plutocracy saps the growth in majority living standards. Without that growth, we argued, “populist” responses are inevitable, and this state of affairs “does not bode well for the coexistence of capitalism and liberal democracy in the future.”

10 “Beware the Borg,” Economist, December 21, 2019, 63–64.

11 Heidi Haidilun and Tom Mackenzie, “China Fossil Fuel Deadline Shifts Focus to Electric Car Race,” Bloomberg, September 10, 2017.

12 World Bank “Gross Capital Formation (percent of GDP)—China, United States,” World Bank Open Data, accessed January 28, 2020.

13 This is not to say that China has always executed its projects—from new cities to Coronavirus quarantine facilities—with full competency, of course. Nor is it in any way to defend every aspect of China’s authoritarian state, including mass surveillance, persecution of its Uighur minority, or its less-than-transparent economic data. But none of those features are essential to economic planning, which is the critical driver of rapid and relatively widely shared growth.

14 Greg B. Smith, “Port Authority Delays 1 World Trade Center Opening as Project Takes More Time, Money Than Expected,” New York Daily News, September 6, 2014.

15 World Bank “GDP Growth (annual percent)—China, United States, European Union,” World Bank Open Data, accessed January 8, 2020.

16 World Bank, “GDP Per Capita (Constant 2010 US$),” World Bank Open Data, accessed March 23, 2020.

17 Pippa Stevens, “Here Are the 10 Companies with the Most Cash on Hand,” CNBC, November 7, 2019.

18 T. Wang, “Annual Average Infrastructure Expenditures as Percent of GDP Worldwide from 2010 to 2015, by Country,” Statista, August 9, 2019.

19 Federal Reserve Bank of St. Louis, “(Net Government Investment: Federal: Nondefense+Net Domestic Investment: Government: State and Local)/Gross Domestic Product*100,” FRED Economic Data, accessed March 20, 2020.

20 Rachel Barker and Joseph Parilla, “Detroit’s Big Bet on Small Business,” Brookings, May 23, 2017. See also Craig A. Zabala and Jeremy M. Josse, “Shadow Banking: Rising Opportunities in the Private Middle Market,” KPMG Institutes (New York: KPMG Advisory Institute and Global Enterprise Institute, October 2013), 1–12; and Craig A. Zabala and Jeremy M. Josse, “Shadow Credit and the Private Middle Market: Pre-Crisis and Post-Crisis Developments, Data Trends, and Two Examples of Private, Non-Bank Lending.” Journal of Risk Finance 15, no. 3 (May 2014): 214–33.

21 See Celine McNicholas, Margaret Poydock, Julia Wolfe, Ben Zipperer, Gordon Lafer, and Lola Loustaunau, Unlawful: U.S. Employers Are Charged with Violating Federal Law in 41.5 percent of All Union Election Campaigns (Washington, D.C.: Economic Policy Institute), December 11, 2019.

22 Gary Rivlin, “The Stimulus Halts a Corporate Trick That Gouges Workers. But It Comes Too Late,” Washington Post, March 27, 2020.

23 “U.S. Stock Ownership: Who Owns? Who Benefits?” Globalist, September 19, 2013.

24 The Annual Report of the U.S. Securities and Exchange Commission. Select SEC and Market Data from 1939 to 2003 and 2004 to 2014 (Washington D.C.: U.S. Securities and Exchange Commission, 2019).

25 David MacLaughlin and Annie Mass, “The Hidden Dangers of the Great Index Fund Takeover,” Bloomberg Businessweek, January 13, 2020, 20–25.

26 MacLaughlin and Massie, “Hidden Dangers,” 20.

27 Federal Reserve Bank of St. Louis, Economic Research Division, accessed February 1, 2020.

28 Craig A. Zabala and Jeremy M. Josse, “Shadow Credit in the Middle Market: The Decade after the Financial Collapse,” Journal of Risk Finance 19, no. 5 (November 2018): 414–36.

29 Jason Kavanaugh, “The Rise of Family Offices: 10-Fold Growth in Less Than a Decade,” Real Assets Adviser, March 1, 2018.

30 Jeffrey Vögeli and Jan-Henrik Förster, “Swiss Savers Are Storing Cash in Boxes in Order to Tackle Negative Interest Rates,” Independent, September 10, 2016.

31 Allana Akhtar, “The 2020s Could Be an Apocalyptic Decade for Wall Street as Artificial Intelligence Takes Over the Most Popular Jobs in Finance,” Business Insider, December 9, 2020. See also Don Tait and Ruomeng Wang, Artificial Intelligence in Banking Report—2019 (London: IHS Markit, April 2019).

32 Akhtar, “The 2020s.”

33 Jason Wiens and Chris Jackson, The Importance of Young Firms for Economic Growth (Kansas City, Mo.: Ewing Marion Kauffman Foundation, September 24, 2014).

34 Ben Casselman, “Corporate America Hasn’t Been Disrupted,” FiveThirtyEight, August 8, 2014.

35 E. J. Reedy and Robert E. Litan, Starting Smaller; Staying Smaller: America’s Slow Leak in Job Creation (Kansas City, Mo.: Ewing Marion Kauffman Foundation, July 2011).

36 Ian Hathaway and Robert E. Litan, “Declining Business Dynamism: It’s for Real,” Brookings, May 22, 2014.

37 Evelyn Cheng, “China Is Indicating It’ll Never Give in to U.S. Demands to Change Its State-Run Economy,” CNBC, May 27, 2019.

38 Kai-Fu Lee, AI Super-Powers: China, Silicon Valley, and the New World Order (New York: Houghton Mifflin Harcourt, 2018).

39 China Power Team, “What Does China Really Spend on Its Military?” China Power, December 28, 2015.

40 This is arguably least true in the case of the Scandinavian countries, which—despite recent and continuing attempts at rollback—retain much more thoroughgoing social democratic norms, including the willingness of their professional class to be taxed for the provision of ample public goods. Perhaps not coincidentally, most professionals in these countries are in trade unions that bargain nationally.

41 Josh Bivens and Lawrence Mishel, Understanding the Historic Divergence between Productivity and a Typical Worker’s Pay, EPI Briefing Paper 406 (Washington, DC: Economic Policy Institute, September 2, 2015).

42 Dean Baker of the Center for Economic and Policy Research (CEPR) has written at length about the ways the system is, as he puts it, “rigged” with guilds and other barriers to entry that collectively allow doctors, orthodontists, corporate lawyers, and other high-income professionals to capture excessive rents. See especially his seminal book Rigged: How Globalization and the Rules of the Modern Economy Were Structured to Make the Rich Richer (Washington, D.C.: Center for Economic and Policy Research, 2016).