World leaders recently gathered in Glasgow for “COP26,” the latest UN climate change conference. At the top of the agenda was the need for carbon mitigation actions to achieve the Paris Accord’s goals and to reach net-zero emissions by mid-century. In anticipation of the conference, the European Commission released the “European Green Deal,” a package of measures that aims to make the European Union “carbon-neutral” by 2050. The policies the Commission describes as “transformational” steps toward a “green industrial revolution” include mandating more wind and solar and banning new gasoline and diesel cars by 2035.1 The European Union’s goal is clear: “this set of proposals aims to set an agenda to work with the rest of the world towards a green transition that addresses existential threats and creates new opportunities for all.”2 Less diplomatically, the goal is to goad the Biden administration into European-style “Green New Deal” policies to transition the U.S. economy away from fossil fuels and toward electric cars and renewables. Consistent with that expectation, President Biden has announced an intent to cut emissions in half by 2030 (compared to 2005 levels)—a quixotic goal that would require cuts equivalent to eliminating all carbon emissions from the U.S. electricity and industrial sectors in just nine years.

President Biden should stop his ears to the siren song of climate utopianism. Levelheaded climate diplomacy must instead recognize two inconvenient truths about U.S. interests.

First, policies that restrict the domestic supply of oil and gas and mandate renewable and electric car deployment will reduce U.S. geopolitical power. The United States is the world’s largest producer of oil and gas. It is a net loser from unilateral restrictions on domestic hydrocarbons, while Russia, Saudi Arabia, and Iran have the most to gain, as a decline in U.S. supply increases their power to set cartel prices. China, on the other hand, is the largest net importer of oil and gas, but the dominant producer of “green” substitutes like solar panels, battery cells, and critical minerals. “Greening” the U.S. economy at the scale envisioned by the Biden administration would damage U.S. growth while jeopardizing U.S. national security and even global stability. It would empower antagonistic regimes like Russia, Saudi Arabia, and Iran, while reducing U.S. leverage with China.

Second, these policies would not effectively curb global emissions. They would simply subsidize continued emissions in other countries. Domestic “Green New Deals” will impose enormous costs on U.S. citizens far above the projected costs of the avoided climate damages. Cass Sunstein, President Obama’s regulatory czar, puts the implication this way: “The United States and China are the largest emitters, and on prominent projections, they also stand to lose relatively less from climate change. In terms of their own domestic self-interest, these projections greatly weaken the argument for stringent controls.”3 Climate idealists, who argue that the United States must nevertheless lead, ignore the free rider problem this policy approach creates. If the United States agrees to bear a disproportionate share of the cost of mitigating climate damages, this will reduce the need of foreign countries to curb their own emissions. Put bluntly, disproportionate U.S. mitigation policies compared to the rest of the world are a form of foreign aid that enlarges China and India’s “carbon budgets.” China and India understand this reality, which is why they have no immediate plans to even begin reducing carbon emissions and likely why they even failed to update their Paris commitments.4 U.S. climate diplomacy must recognize the perverse incentives created by this kind of foreign aid.

America Dominates Global Oil and Gas Supply Chains While China Dominates “Green” Energy Substitutes

U.S. climate diplomacy must be anchored in hard facts about global energy. Those facts show that unilateral domestic supply and demand cuts in oil and gas are not in the interest of the United States.

Oil. The United States is the largest producer of oil, responsible for nearly a fifth of the world’s oil production.5 Thanks to the hydraulic fracturing revolution, the United States is a net exporter of oil.

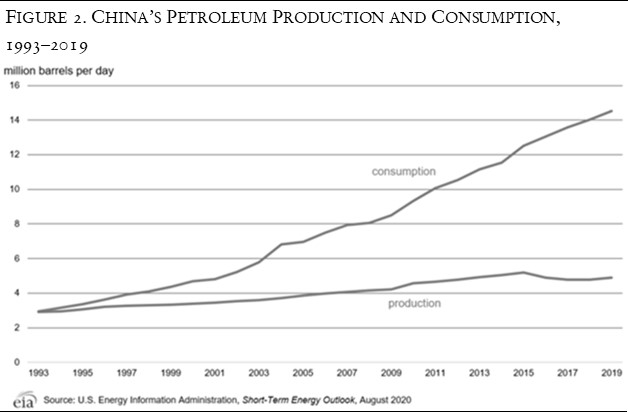

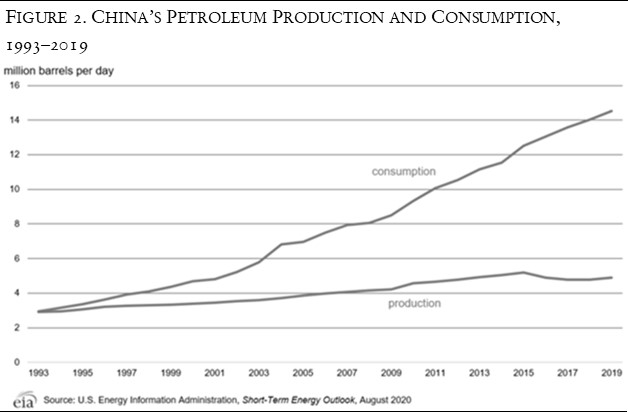

China, on the other hand, is the world’s largest net importer of oil. China has few oil reserves, and its dwindling domestic supplies come from legacy fields that require expensive enhanced-recovery methods. China’s demand for oil is also rapidly increasing. This explains China’s long-term bet on powering transportation with electricity: China can use its abundant coal reserves, hydropower, and growing nuclear capabilities to power battery-electric cars, vans, and trucks. The European Union, for its part, produces nearly no oil and meets its domestic oil needs through imports.6

Natural gas. The United States, Russia, and Iran dominate natural gas production. The United States is the leading producer of natural gas, producing nearly a quarter of the world’s supply. Russia produces 17 percent, and Iran only 7 percent.7 The United States is the second-largest exporter of natural gas after Russia, and liquified natural gas (LNG) exports are growing rapidly as liquefaction facilities are approved, notwithstanding permitting delays.

China is the world’s largest net importer of natural gas, and net imports are growing fast as China seeks ways to mitigate the ambient air quality problems caused by its reliance on coal as a source of energy for cooking, heating, and electricity.8 China’s coal addiction prematurely kills roughly four hundred thousand Chinese each year, half of the military casualties of the entire U.S. Civil War. With an aging population, increasing urbanization, and the expanding use of coal, this number will likely increase in the coming years.9

The European Union, likewise, meets nearly all of its domestic natural gas needs through imports.10 Its natural gas dependency is increasing as existing gas fields are depleted and fracking bans and red tape limit any shale gas exploration. The European Union’s largest gas trading partner is Russia’s Gazprom, and Russia’s share of EU imports is growing.11 The Biden administration recently agreed to remove U.S. sanctions preventing the completion of a new, controversial Russian pipeline (Nordstream 2), a second Gazprom pipeline delivering natural gas directly to Germany, before issuing a few timid sanctions in August. Nordstream 2 will allow Gazprom to avoid the gas “transit” fees it pays Poland and Ukraine and increase Russia’s ability to cut gas supplies to Ukraine or other eastern European countries without disrupting supplies for its German customers. In exchange, Ukraine will get $50 million in “green” technology investments from the U.S. and Germany.12

Critical minerals. Critical minerals are raw materials needed to transition energy economies to renewable electricity and battery-powered transportation systems. An electric car requires six times the mineral inputs of a conventional car, and an offshore wind plant requires thirteen times more mineral resources than a similarly sized gas-fired power plant. Critical minerals include lithium, rare earths, copper, nickel, silicon, manganese, cobalt, zinc, chromium, and graphite.13 Lithium, nickel, graphite, cobalt, and manganese are needed to build lithium-ion batteries.

China dominates these critical mineral supply chains. China controls nearly two-thirds of all lithium, four-fifths of the refined cobalt market, and nearly all processed natural graphite.14 In stark contrast to its oil and gas dominance, the United States has nearly no control of critical mineral supply chains and produces less than a tenth of the world’s battery cells, while China is the world’s leading producer. China controls much of the extraction of these materials and has 90 percent of the world’s rare earth element processing capacity,15 cornering the market for the core minerals of electric car batteries, and dominating battery and renewable supply chains.

The scope of China’s dominance has only been expanded by the fall of Kabul to the Taliban in August of this year. Afghanistan, “the Saudi Arabia of lithium” according to the Department of Defense, possesses mineral wealth valued at $1 trillion or more.16 China has already laid the groundwork to exploit these minerals—investing in Afghan infrastructure through its Belt and Road Initiative and hosting the Taliban in diplomatic talks—prompting the Taliban to refer to China as its “most important partner.”17

A European-Style Green Energy Transformation Is Not in the Geopolitical Interests of the United States

These energy facts do not lie. The United States, China, and the European Union face a vastly different geopolitical and economic calculus when it comes to climate diplomacy and mitigation policies.

China’s “climate” policies, limited as they are, can be explained as promoting their own domestic industrial growth and energy independence. China recognizes oil and gas dependence as a key strategic weakness. Much of China’s oil and LNG imports are shipped from the Middle East through the Strait of Malacca, a key choke point that could be exploited by rivals.18 Should China threaten an invasion of Taiwan, for example, the U.S. Navy could block much of its energy supply. China’s response to this strategic weakness is pushing the world to rely on energy sources where China is ahead, such as electric cars and solar panels, while shoring up its energy security through oil and gas import agreements with Central Asia and Russia. China has also bolstered its natural gas supply by signing a $400 billion agreement with Russia on a gas pipeline—the Power of Siberia—finalized in 2019.19 A second pipeline, Power of Siberia 2, is being planned. China’s turn to renewables and nuclear energy will further boost Beijing’s energy independence.

European climate policies serve their geopolitical interest in diversifying their sources of energy, given their lack of any control over oil and gas supply chains. Even so, from a purely cost-benefit standpoint, their abatement policies are difficult to justify. Look no further than Germany, whose shift to renewables over the past two decades has resulted in an enormous wealth transfer to China.20 And this wealth transfer has hardly been efficient at reducing carbon emissions—renewables capacity has grown to 40 percent, but German energy prices have doubled, and solar panels operate only about a tenth of the time in cloudy Germany. German emissions have not fallen any faster than emissions in the United States, where the costs of electricity have declined significantly as a result of inexpensive and abundant low-carbon natural gas.21

In contrast to Europe and China, “Green New Deals” in the United States profoundly conflict with national interests. In the United States, hydrocarbons are the goose that lays the golden eggs. The U.S. oil and gas industry supports twelve million jobs, contributes 8 percent of U.S. GDP, and reduces the U.S. trade deficit by over $300 billion.22 Low natural gas prices increase U.S. growth and industrial competitiveness, while improving air quality and reducing domestic carbon emissions.23

In addition, domestic oil and gas abundance has increased America’s ability to shape and punish foreign behavior short of military action. OPEC has been greatly weakened. The United States has been able to impose unprecedented sanctions on major hydrocarbon producers like Iran, Venezuela, and Russia, when they have acted badly, cutting their oil and gas exports and access to foreign investment, without triggering major oil and gas price shocks. Reduced hydrocarbon prices and exports have also reduced the need for extensive U.S. military involvement in the Middle East. Moreover, a natural gas surplus allows the United States to ship LNG to Eastern Europe, deepening U.S. economic ties there and checking Russia’s economic leverage.

Quite simply, the Biden administration’s target of net-zero by mid-century requires killing this golden goose. Already, Americans are approaching a cold and expensive winter made worse by Biden’s policies. And the worst is yet to come. Consider the International Energy Agency’s (IEA) roadmap to net-zero, a “study of how to transition to a net zero energy system by 2050.”24 The IEA roadmap envisions banning all new oil and gas development immediately and cutting global oil consumption in half by 2040 as the world’s population grows by two billion people. By 2050, in the IEA’s roadmap, “[g]as demand declines by 55% to 1,750 billion cubic meters and oil declines by 75% to 24 million barrels per day (mb/d), from around 90 mb/d in 2020.”25 “The drop in oil and gas demand, and the consequent fall in international prices for oil and gas, cause net income in producer economies to drop to historic lows.”26 The United States sees a disproportionate fall in oil and gas production and income as depressed prices make U.S. “tight” oil and gas uncompetitive with Saudi oil.

Apart from harming the U.S. economy, this energy shift would have severe geopolitical implications. OPEC nations like Saudi Arabia produce oil at a much lower marginal cost than the United States, and IEA projects that by mid-century OPEC would account for half of the oil supply, a return to global oil energy insecurity.27

The story would be similar for natural gas output restrictions. U.S. natural gas is a useful counterweight to Russian influence. U.S. gas exports weaken Russia’s economic power over the European Union, as the availability of U.S. LNG limits Russia’s ability to shut down gas supplies to create severe price shocks and shortages.28 Reducing U.S. natural gas output jeopardizes countries like Poland and Lithuania and expands Russia’s economic influence. It would increase the market power of Middle Eastern suppliers of natural gas—most prominently an ambitious Iran. It would also erode the ability of the United States to credibly use economic sanctions to embargo and sanction regimes that threaten its strategic interests.

By contrast, critical mineral demand would vastly expand to build electric cars and renewables, exposing the United States to a serious threat of economic embargoes from China that could affect U.S. power and transportation sectors.

But IEA’s “net-zero” estimates are too optimistic. IEA’s roadmap assumes perfect global collaboration in coordinating trade and regulation policies and sharing “clean energy” R&D. (U.S. firms own most “clean energy” patents, so this envisions a vast voluntary transfer of intellectual property to the rest of the world.29) In an alternative scenario of imperfect global cooperation, global net-zero is not reached until 2090 even while adopting the same mitigation policies.

And IEA’s “alternative” still unrealistically assumes that countries as unreliable as Russia, Iran, Venezuela, India, and China adopt climate policies in near lockstep with North America and Europe. IEA assumes that all advanced economies eliminate coal-fired generation by 2030 and that all emerging economies do so by 2040.30 That assumption lacks any basis in reality. India plans to have coal provide most of its energy until 2047, and coal is politically entrenched there.31 Russia has zero interest in achieving zero emissions. China built three times as many coal-generation plants as the rest of the world combined—in 2020.32 China’s promises of net-zero emissions by 2060, with plans for increasing emissions until 2030, should be regarded with skepticism. China, India, and other developing nations expect that reductions in North America and Europe will pave the way for them to emit vast amounts of carbon well into the future at foreign expense. Before requiring its citizens to accept dramatic reductions in their own standard of living, the United States must solve this free rider problem.

Furthermore, all of this presumes that the abatement required to meet the Biden administration’s goal even makes sense globally. It does not. The Biden administration’s net-zero goal, trying to avoid a 1.5-degree Celsius warming by 2100, is not based on any rigorous cost-benefit analysis. In his Nobel Prize lecture, climate economist William Nordhaus explains that based on his Dynamic Integrated Climate-Economy (“DICE”) model, holding average temperatures under 1.5 degrees Celsius by 2100 would likely cost the world about ten times as much as the avoided climate damages, a cost-benefit ratio of 10 to 1, equivalent to over $45 trillion in net costs. The “optimal” scenario according to DICE would be to target an increase of 3.5 degrees Celsius by 2100.33 And that optimal target again assumes optimal carbon pricing policies and global agreement—no free riders. With free riders and an ineffective hodgepodge of abatement policies (our current situation), even a 3.5-degree Celsius increase would be far too ambitious.

A Geopolitically Responsible Climate Policy

If the excesses of the Biden administration are not in the best interests of the United States, then what would responsible U.S. climate diplomacy and policy leadership look like?

First, the United States must reject the infeasible “net-zero by 2050” goal. The United States should set realistic targets and expectations based on rigorous cost-benefit analysis. Pursuing reasonable goals with bipartisan approval, instead of making unenforceable promises, would be a first step to serious and responsible leadership.

Second, U.S. climate policy must recognize the global nature of energy markets and the free rider problem. Global energy supply meets demand. Oil can be transported at low cost in tankers and redirected all over the world. Low transportation costs and spot pricing mean that oil is a global commodity subject to near-perfect price arbitrage. This means that if any country cuts oil production, oil demand will simply find a substitute source of supply at higher prices. The story for natural gas is more complex, but natural gas markets are trending global with LNG growth.34

Energy globalization means that cuts in the U.S. supply of oil and gas will shift energy production elsewhere. Jason Bordoff, the cofounding dean of the Columbia Climate School and a former climate and energy adviser to President Barack Obama, wrote in Foreign Policy in June, “Unless both supply and demand change in tandem, merely curbing the oil majors’ output will either shift production to less accountable producers or have potentially severe consequences on economic and national security interests while doing little to combat the climate crisis.”35 In a similar vein, the Brookings Institution has emphasized that “cutting back domestic oil and gas production without an equally ambitious focus on demand will just increase U.S. imports, rather than reduce consumption. The United States could lose the economic advantages of its oil and gas production without a commensurate reduction in [greenhouse gas] emissions.”36

An extreme example of a counterproductive policy shock to U.S. supply is the hydraulic fracturing ban advocated by Senator Bernie Sanders and Representative Alexandria Ocasio-Cortez.37 Hydraulic fracturing accounts for three-quarters of all natural gas and two-thirds of all oil produced in the United States, and a ban would entirely destroy this supply.38 It would thus result in “7.7 million fewer jobs, $1.1 trillion less in gross domestic product (GDP), and $950 billion less in labor income” by 2025.39 A ban would also increase domestic air pollution and power sector carbon dioxide emissions, as increased coal generation would be needed to make up for a decline in natural gas to backup intermittent renewables.40 To avoid a complete economic collapse, roughly three-quarters of U.S. natural gas demand and two-thirds of all U.S. oil demand would need to be replaced with foreign imports overnight, offshoring U.S. hydrocarbon production abroad while doing little or nothing to reduce global carbon emissions. A fracking ban would in short be the equivalent of adopting an infinitely high carbon tax for U.S. tight oil and gas, with no equivalent carbon tax for any foreign oil and gas. Nothing could please Russia, Iran, Saudi Arabia, and China more.

President Biden is unlikely to ban hydraulic fracturing, as that would be political suicide. But a “death-by-a-thousand-cuts” approach—like freezing oil and gas leases on federal lands or lengthening the time of environmental permitting reviews for infrastructure projects (e.g., LNG export facilities) will also harm U.S. interests. Already, natural gas pipeline restrictions in the Northeast make it difficult for abundant U.S. natural gas from Pennsylvania to reach New England, which has imported Russian LNG even as Russia is under Ukraine-related economic sanctions. Instead of ceding energy production to other powers, the United States could commit to being a net exporter of energy and controlling the air pollution that results. U.S. natural gas exports, with roughly half of the carbon intensity of coal and low methane emissions, could reduce the carbon intensity of foreign economies. But to do this, the United States would need to be promoting natural gas exports by building LNG capabilities, not hampering LNG with red tape.

The lesson is this: to the extent the United States pursues emissions abatement, it will have to deal with global market realities as well as the free rider problem. If not, America will be paying to transfer hydrocarbon production abroad and license greater pollution in India and China. But dealing with these foreign problems requires a combination of actual international treaties—requiring approval by two-thirds of the Senate—and border adjustments on imports and exports, which may need congressional approval. An executive “pen-and-phone” climate agenda without Congress will hurt the United States and may do nothing at all to curb global carbon emissions.

Third, the United States must be a leader in technological innovation, not red tape. In particular, the United States should invest resources in underfunded alternatives to renewables and batteries that pose less long-term risks to U.S. geopolitical and economic interests: hydrogen fuel cells and biofuels for mobility and industry,41 small nuclear reactors for power,42 and carbon capture and storage.43 The current near-exclusive focus on renewables and battery mobility is a recipe for failure and increased dependence on China. Leaving future energy supply chains reliant on a China that is willing to lap the world in coal plant production,44 to create black, sulfurous, toxic lakes,45 to use slave labor,46 and to partner with the Taliban47 is not just bad geopolitics, it is morally obtuse. Only by taking responsibility for energy can the United States be a climate leader.

This article originally appeared in American Affairs Volume V, Number 4 (Winter 2021): 80–92.

Notes

1 “

European Green Deal: Commission Proposes Transformation of EU Economy and Society to Meet Climate Ambitions,” European Commission, July 14, 2021.

2 “‘Fit for 55’: Delivering the EU’s 2030 Climate Target on the Way to Climate Neutrality,” European Commission, July 14, 2021.

3 Cass R. Sunstein, “World vs. the United States and China—The Complex Climate Change Incentives of the Leading Greenhouse Gas Emitters,” UCLA Law Review 55, no. 6 (2007): 1688.

4 Frank Jordans, “China, India Miss UN Deadline to Update Emissions Targets,” Associated Press, July 31, 2021.

5 “Total Oil (Petroleum and Other Liquids) Production,” U.S. Energy Information Administration, April 1, 2021.

6 “Energy Production and Imports,” Eurostat, June 2021.

7 Stephen Nalley and Angelina LaRose, “International Energy Outlook 2021,” U.S. Energy Information Administration, October 6, 2021.

8 Nalley and LaRose, “International Energy Outlook 2021.”

9 “Burden of Disease Attributable to Coal-Burning and Other Air Pollution Sources in China,” Health Effects Institute, August 2016.

10 “Provisional Natural Gas Balance Sheet, by Country, 2018-2019,” Eurostat, 2019.

11 “Energy Production and Imports,” Eurostat, June 2021.

12 Bojan Pancevski and Brett Forest, “U.S.-German Deal on Russia’s Nord Stream 2 Pipeline Expected Soon,” Wall Street Journal, July 21, 2021.

13 “The Role of Critical Minerals in Clean Energy Transitions,” International Energy Agency, May 2021.

14 “Risks and Opportunities in the Battery Supply Chain,” Massif Capital, May 2019; Nicholas LePan, “The New Energy Era: The Lithium-Ion Supply Chain,” Visual Capitalist, December 11, 2019; Sophie Damm and Qizhong Zhou, Supply and Demand of Natural Graphite (Berlin: DERA Rohstoffinformationen, July 2020).

15 Ariel Cohen, “As U.S. Retreats, China Looks to Back Taliban with Afghan Mining Investments,” Forbes, August, 17, 2021.

16 Tim McDonnel, “The Taliban Now Controls One of the World’s Biggest Lithium Deposits,” Quartz, August 16, 2021.

17 Cohen, Forbes.

18 “The Strait of Malacca, a Key Oil Trade Chokepoint, Links the Indian and Pacific Oceans,” U.S. Energy Information Administration, August 11, 2017.

19 Isabella Nikolic, “Vladimir Putin and Xi Jinping Open First Giant Gas Pipeline between Russia and China as Part of $400 Billion Deal,” Daily Mail, December 2, 2019.

20 Daniel Yergin, The New Map Energy, Climate, and the Clash of Nations (New York: Penguin Random House, 2020), 83. “Although not the intent, [Energiewende] also ended up indirectly providing large subsidies to Chinese solar companies, which became the main low-cost suppliers of solar panels to the world.”

21 Vaclav Smil, “Germany’s Energiewende, 20 Years Later,” IEEE Spectrum, November 25, 2020.

22 “The Economic Benefits of Oil and Gas,” Department of Energy, October 2020; “Oil and Natural Gas,” American Petroleum Institute, 2018.

23 “Economic and National Security Impacts under a Hydraulic Fracturing Ban,” Department of Energy, January 2021.

24 “Net Zero by 2050,” International Energy Agency, June 2021.

25 “Net Zero,” International Energy Agency, 20.

26 “Net Zero,” International Energy Agency, 156.

27 “Net Zero,” International Energy Agency, 175.

28 Jason Bordoff and Trevor Houser, “American Gas to the Rescue?,” Columbia Center on Global Energy Policy, September 2014.

29 Bordoff and Houser, “American Gas to the Rescue?,” 187–190.

30 Bordoff and Houser, “American Gas to the Rescue?,” 116.

31 Sudarshan Varadhan, “Coal to Be India’s Energy Mainstay for Next 30 Years,” Reuters, May 15, 2017.

32 “China Dominates 2020 Coal Plant Development,” Global Energy Monitor, February 2021.

33 William D. Nordhaus, “Climate Change: The Ultimate Challenge for Economics,” Nobelprize.org, December 8, 2018.

34 Nikos Tsafos, “Is Gas Global Yet?,” Center for Strategic and International Studies, March 23, 2018.

35 Jason Bordoff, “Why Shaking Up Big Oil Could Be a Pyrrhic Victory,” Foreign Policy, June 3, 2021.

36 Samantha Gross, “The United States Can Take Climate Change Seriously While Leading the World in Oil and Gas Production,” Brookings Institution, January 27, 2020.

37 U.S. Congress, House, Fracking Ban Act, HR 5857, 116th Cong., 2nd sess., introduced February 12, 2020.

38 “Annual Energy Outlook 2021,” Energy Information Administration, 2021.

39 U.S. Department of Energy, Economic and National Security Impacts under a Hydraulic Fracturing Ban (Washington, D.C.: Department of Energy, January 2021).

40 U.S. Department of Energy, Economic and National Security Impacts under a Hydraulic Fracturing Ban.

41 “New Combustion Strategies Plus Biofuels Add Up to Cleaner, More Efficient Cars and Trucks,” National Renewable Energy Laboratory, May 18, 2021.

42 “Nuclear Power in a Clean Energy System,” International Energy Agency, May 2019.

43 John Fialka, “Carbon Capture Technologies Are Improving Nicely,” Scientific American, May 7, 2021.

44 “China Dominates 2020 Coal Plant Development,” Global Energy Monitor, February 2021.

45 Tim Maughan, “The Dystopian Lake Filled by the World’s Tech Lust,” BBC, April 2, 2015.

46 Joel Hruska, “Report: China Sells Minorities into ‘Forced Labor’ to Benefit Apple, Foxconn, Others,” ExtremeTech, March 3, 2020.

47 Cohen, Forbes.