Rebuilding British Industry: A Plan for the Post-Brexit Economy

Today Britain finds itself in an odd position. In the wake of the vote to leave the European Union and its aftermath, the Conservative Party has been given a new mandate. A substantial portion of the voting public wants a more independent Britain to pursue national restoration and regeneration. On an emotional level, most of the Conservative Party has been won over by this vision. Rallying around the departure from the EU, Conservative Party politicians have signaled to their party membership, as well as the voting public, that they are willing to lead the country in a new direction.

This Damascene conversion has, however, generated contradictions. On the face of it, the vote to leave the EU was one motivated by skeptical attitudes toward the laissez-faire policies that have dominated British political life for decades. The most obvious outcome of the exit from the EU will be to halt the “free movement of people”—that is, mass migration—and increase trade barriers with Britain’s largest market. Yet at the same time, the leaders of the Brexit movement—from Nigel Farage to Jacob Rees-Mogg to recent convert Boris Johnson—typically champion Thatcherite free market policies.

The economic policies of these pro-Brexit Tories, however, are ill-suited to the Britain of 2019. Given the degree of political upheaval and change surrounding Brexit, such a deep disconnect between Tory free market ideology and the stated goal of independence could generate chaos. Thatcherite free market policies will almost certainly make the situation worse, not better, especially given Britain’s fragile position. Britain must instead pursue an aggressive industrial and manufacturing policy in order to avert economic crisis after Brexit. To take this path, Tory leaders must follow their better instincts and craft policies that actually match their goals. British independence depends on British manufacturing and domestic consumption. But the free market nostrums of the 1980s will not get us there.

Britain’s Decline: From Imperial Grandeur to Tony Blair

To understand what must be done, let us first consider how the country arrived in such an economically dire situation. In the early 1910s, Britain was on top of the world. It had a huge empire and the world’s most sophisticated economy. Its military spending, which approached £65 million, was the highest in the world—although Germany, now unified and interested in mimicking the British Empire, was a close second. Just prior to the outbreak of World War I, Britain’s per capita GDP was nearly $5,000, far outpacing Germany ($3,650), France ($3,500), Austria-Hungary ($2,000), and Russia ($1,500). It was only really matched by the rapidly growing United States.

By the end of the war, however, Britain was in tatters. The Allies had won the war, but at massive cost. Throughout the 1920s and into the 1930s, Britain tried to maintain its international prestige by jealously defending its gold standard—much to the detriment of the British economy. Policymakers reasoned that what had worked in the past—an imperial economic system based on intraimperial trade, centered on the gold standard and London-based banking, would work in the future. Critics pointed out that the high imperial era was over, and that Britain would do better to focus on its domestic market.

Britain fumbled throughout the interwar years, gradually giving way to the new economic ideas and dropping the gold standard in 1931. But no fundamental reform was undertaken, and the British economy languished. For this reason, Britain went into World War II with significant economic disadvantages. What happened next was all but inevitable: the United States, now with global ambitions, financed British war expenditure knowing full well that the resulting debt would destroy Britain’s global reach.

After the war, the script played out as if pre-written. Britain found itself totally overshadowed in the global arena by the United States. The debts that Britain owed hung over her head like a glistening sword, and the Americans were eager to use the leverage they had gained to encourage the unraveling of the British Empire. This came to a head in 1956 when the Egyptians nationalized the Suez Canal, a key trading route required for the British imperial economic system to function. The British knew that they had to respond militarily, but the Americans were happy to see them lose their empire. President Eisenhower warned the British that if they carried through with an invasion, he would sell the debt that the British owed the Americans, thereby crashing the sterling and sending the country into financial ruin. Eventually the British backed off and watched as their empire fell apart in the ensuing years.

Since the nineteenth century, Britain’s economy had been based on the imperial system. Trade would occur within the system, and the City of London would make the necessary financial arrangements. The British never admitted to themselves that their economic success was based on empire, however. During the imperial era and after, they clutched at the myth that the system was based on so-called free trade. British political economy even turned this mythology into a pseudoscientific theory. It was the very essence of ideology: it was designed to reassure the British people—and the world—that Britain had not achieved success through conquest and military force, but rather through hard-fought economic competition.

This ideology was harmless when Britain was in its ascent. But it became toxic when Britain started to decline. It blinded the British from seeing that, as their empire collapsed, so too did their economic system. In the decades after World War II, this ideology was mainly focused on maintaining the gold standard—just as it had been in the 1920s. As other economies were racing ahead, using Keynesian economic programs to push high rates of economic growth and full employment, Britain got stuck in the dreaded “stop-go” cycle. The British would encourage economic growth but, as imports were sucked in to fuel the growth, the sterling would wobble and the British authorities’ attempts to protect the gold standard would lead to recession.

In the imperial era, Britain would grow in lockstep with the rest of the empire. And since the empire was a closed system, as British imports from the empire increased, so too did British exports. In the postwar world, however, Britain was facing international competition, especially from the United States, and its exporters were only competitive in underdeveloped colonies like India. Since Britain was never the free market success story that it claimed to be, it languished in this new world. It was unable to keep up with the other developed economies because of its tendency to suck in imports as it grew.

The stop-go cycle of the postwar era fell into terminal crisis in the 1970s. British workers had had enough with multiple governments’ unkept promises, and they turned to radicalism. This radicalism manifested in mass strikes which generated supply shortages and inflation. This situation was exacerbated by the oil price shock in 1973, when oil prices soared as the newly formed OPEC halted production in response to the Yom Kippur War. By the late 1970s Britain was a mess. Garbage went uncollected, inflation was running in double digits, unemployment was high, and maintaining the sterling was all but impossible. The British went, cap in hand, to the IMF in 1976 and took out a loan—a true signal of national humiliation and defeat.

If the postwar Keynesian era was one of mild misrecognition of the problems Britain faced, what followed was a descent into full-on delusion. When the politicians of the 1920s tried to force the British economy back into its prewar state, it was at least somewhat understandable. After all, the empire still existed and the past that they pined for was not all that distant. The Thatcherites who climbed to power at the end of the 1970s wanted to return to the same era—but they had never lived in that world, and the empire that it relied upon was almost completely dissolved. What had been a sort of reactive conservatism in the 1920s became a nostalgic fantasy in the 1980s.

The immediate goal of the Thatcherites was to bring down inflation and create a nineteenth-century-style “free market.” Under the sway of ideologues like Milton Friedman, they thought that they could achieve this by controlling the supply of money. As the Bank of England experimented with this policy, interest rates went haywire and entered double-digit territory. This generated a massive recession and accelerated the decline of British manufacturing, though it succeeded in stamping out inflation through massive declines in spending growth.

Between 1948 and 1978 the decline of British manufacturing was gradual and was driven by competition from abroad. As I noted earlier, British manufacturing could only successfully compete within the imperial system. When it was subject to global competitive forces, it floundered. After 1978, however, this decline sped up enormously—primarily due to the Thatcherite policies.

In the first place, interest rates rose precipitously, and this rise generated a massive recession that pressured many British businesses to close their doors. In addition, sterling rallied throughout the 1980s. Financial investors saw that Britain offered much higher interest rates than other countries, and foreign capital flowed in. This was exacerbated by the Thatcherites’ deregulation of the British financial sector in the late 1980s—the so-called Big Bang. Unable to compete in global markets for goods and services, Britain turned back to its old imperial banking system and restructured it to make it a center for global finance. The resulting rise in the value of sterling made British manufacturing even less competitive.

By the 1990s, the new model for Britain was clear. The British economy would be totally reliant on financial services. Even the Labour Party embraced this model under the leadership of Anthony “Tony” Blair. Blair was a vacuous liberal left-winger who governed the country through his public relations machine. He portrayed himself and his party as the embodiment of a “cool” new country—one geared toward personal freedom and license. What was supporting this phase of decadence, however, were financial inflows that were anything but stable. These inflows propped up the sterling and allowed British consumers to spend more on goods made abroad. Consequently, during this period, there was a serious deterioration in the British current account.

By the time Tony Blair left office in 2007, Britain was running a current account deficit of around 3.5 percent of GDP and manufacturing had fallen to around 11 percent of total value added, down from around 27 percent in 1978 and 36 percent in 1948. This was an economy running on borrowed time.

The Lion Eats the Unicorn

Cracks appeared in the Thatcherite banking-and-import model when the financial sector started to collapse in 2008. The action was mainly centered around a bank called Northern Rock which, like many of its European and American counterparts, had bought more bad debt than it could handle. As the financial sector melted down, sterling took a hit. After all, strong sterling relied on a vibrant financial sector that could attract foreign capital so that British consumers could live beyond their means. Between January 2008 and January 2009, sterling collapsed by 20 percent. The next hit came in the wake of the vote to leave the EU, which occurred in June 2016. Between May and October 2016, sterling fell an additional 14 percent.

These events were only proximate triggers, however. Britain’s model was never sustainable. It always relied on offering investors incentives to move foreign capital to London. But this required either interest rates so high that the economy could not grow or financial bubbles that would never pop. Neither of these was possible in perpetuity. And so it was inevitable that sterling would eventually start to sink. The party over which Tony Blair had so carelessly presided was bound to end.

At this point in the story, many economists would step in and suggest that things are not all that bad. After all, we have argued that a key driver of the rapid decline in British manufacturing and the reliance on imports that accompanied it was the overvaluation of the sterling. While it is true that a falling currency causes rising import prices for consumers, it is also true that the price of exports tends to fall. This makes the country more competitive in international markets. In theory, then, what the British people lost in their ability to buy imports, they should have gained in higher value-added and hence higher-paid manufacturing jobs.

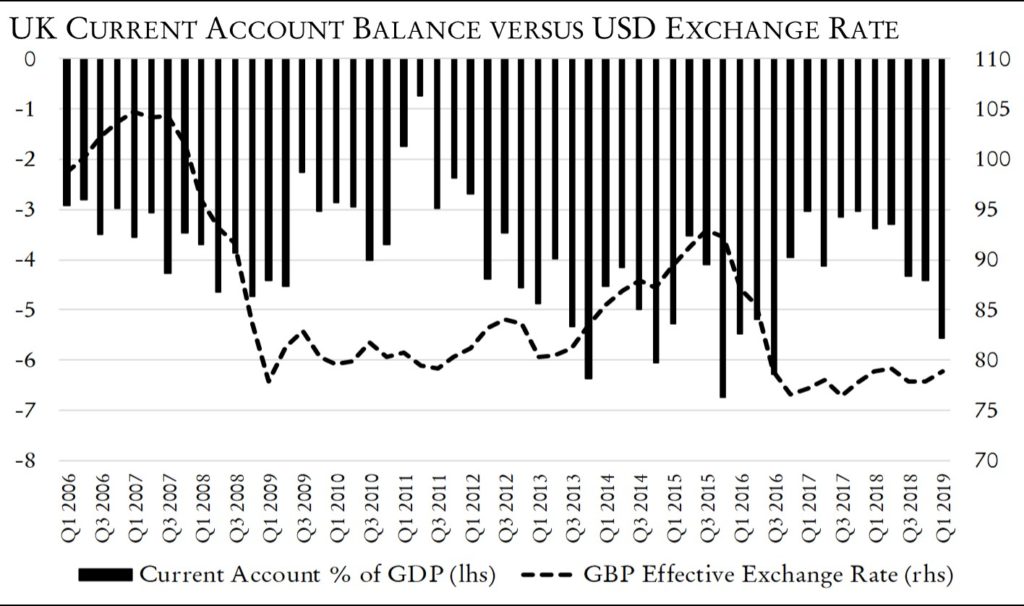

But this did not happen. Exports simply did not rise. The chart below shows the British current account as a percent of GDP against sterling since just before the first leg of sterling’s decline.

The fall of sterling between 2008 and 2009 was accompanied by a decline the current account deficit. But this was due to the large recession that the UK experienced in this period. With unemployment high and people pulling back on spending, imports fell, and the current account closed. But once growth resumed in 2011, despite the new lower-valued sterling, the current account deficit opened once more—this time to record levels, hitting a peak of 6.7 percent of GDP in the fourth quarter of 2015. The same is true of the 2016 decline in sterling: An immediate impact is visible in the data. But it does not last long. By the first quarter of 2019 the current account deficit is back to an extremely large 5.5 percent of GDP.

Why is the decline in sterling not leading to a rebalancing of the current account deficit, as economists would predict? First, Britain has almost no manufacturing capacity. When the income of British people grows, they are forced to spend a good portion of this income on imports. Even if these imports rise in price, there is no alternative but to purchase them anyway (i.e., they are price-inelastic imports). This also means that the real spending power of the British people falls dramatically every time there is a depreciation of sterling.

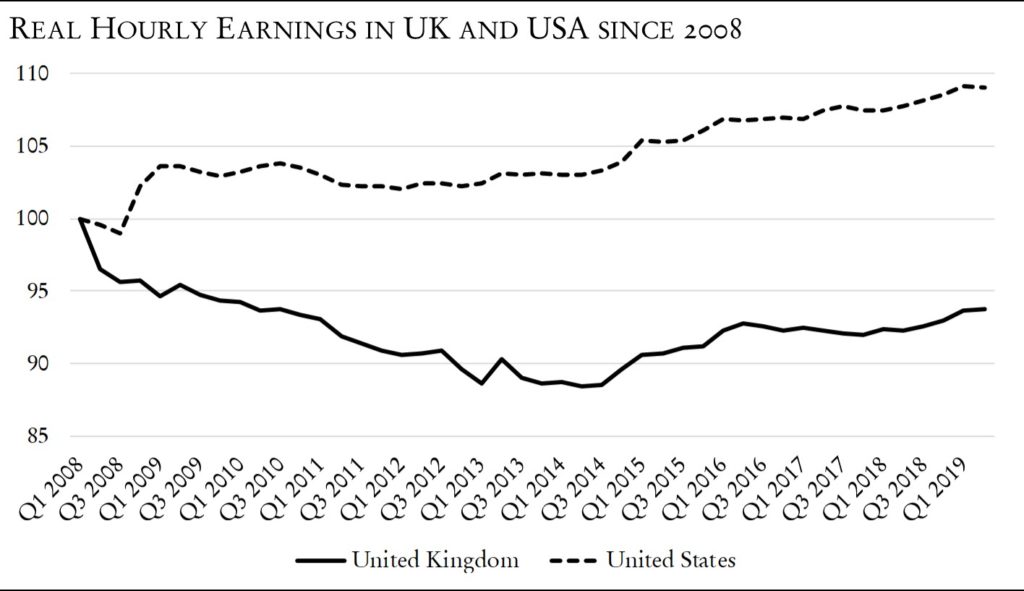

While the real earnings of citizens in other countries have been growing in this period, in Britain they have been falling. Since 2008 real earnings for the average Briton have fallen 6.25 percent. At their trough at the end of 2014, they had fallen an enormous 11.5 percent—a substantial loss in purchasing power and an ominous sign of things to come.

On the one hand, then, the depreciations of sterling were leading to a significant fall in the standards of living of the British people. But what about the export market? It expanded slightly as a percent of total income. But nowhere near enough to support the imports that the British people rely upon. Again, this is because Britain does not really produce all that much. Even if prices fall, there is nothing there to sell. Economists may imagine that currency depreciations cause new factories to pop into existence out of thin air. But after decades of deindustrialization in Britain, it is not surprising that this does not happen.

Britain is in a very difficult position. Unless it can find some way to wean itself off imports, it is sure to see a dramatic fall in living standards in the coming years. The fact that the economy relies almost completely on the fickle financial sector means that trigger events tend to knock real wages down every couple of years. And given Britain’s tumultuous exit from the EU, there are certain to be many trigger events lined up in the years ahead. A new path is needed.

An Escape Hatch

But perhaps it is wrong to view Britain’s exit from the EU as a harbinger of decline. Perhaps it should be seen as an enormous opportunity. To see why, we have to consider where Britain buys its imports, and with whom it runs its deficits.

What the following chart tells us is that, up until 2011, Britain ran large trade deficits with the EU, while trade with non-EU countries was closer to being in balance. Since 2011, Britain is running a surplus with non-EU countries, but larger and larger deficits with the EU. The EU is clearly Britain’s most problematic trade partner.

This situation gives rise to an irony that is not much noticed in British policy circles: net-net, trade with the EU is a bad thing for the British economy, at least from a macroeconomic perspective. Less trade with the EU is, then, from a purely macroeconomic perspective, probably better for Britain’s long-term stability. This fact contradicts almost everything we hear. Policymakers typically characterize any diminishment of trade between Britain and the EU as a bad thing. From the point of view of a British consumer who wants French cheese or Greek yogurt, a reduction in trade certainly is bad. But from the point of view of macroeconomic stability, a diminishment of trade is essential.

Let us step back and think this through for a moment. How could it possibly be a good thing for British consumers to have less access to the goods from the EU that they want? Consider what would happen if we completely cut off trade with the EU tomorrow: Consumers would not have access to EU goods. But they would then have to spend this money elsewhere and some of this—probably most of it—would flow back into the domestic market.

A microeconomist would now point out that consumer satisfaction has fallen. British yogurt and cheese are nowhere near as pleasant as Greek yogurt and French cheese. But if the above macroeconomic analysis is correct, the alternative is that British living standards are destined to fall regardless. The question then becomes, what is the optimal way to manage the fall of these living standards in order to generate the best possibility of subsequently raising them again?

Marching along, enjoying all the continental yogurt and cheese that the debt-soaked British consumer can afford is a path to economic suicide. It is, of course, great for immediate consumption. But it provides no coherent plan for the future. When the continental goods become too expensive, the British consumer will have nowhere to turn, and British industry may take years to respond to the new situation. On the other hand, if a government could look forward to the new alignment that is coming, it could plan for it. The state could direct investment spending into needed industries.

The departure from the EU could provide just the shock necessary for the British people to realize that the current model is not sustainable. It might lead policymakers to ask some long-overdue questions: e.g., why do we assume trade with the EU is purely a good thing when they seem to be running rings around us, while we seem to be building up macroeconomic imbalances for which we will be severely punished in the future?

Buying British: A Platform for the Post-Brexit Economy

What would an appropriate reform platform look like? As noted earlier, the Conservative Party has inherited a political situation that cries out for action on a national level—and they have inherited an economic situation which requires the same. Were it not for free market ideology, the political and economic situations should tend toward parallel solutions. But the Tories are under the sway of an irrational nostalgia for free trade based on a nineteenth-century economy that never truly existed.

If they could overcome these ideological blinders, they could indeed pull Britain out of its rut. They would have to concentrate as many economic forces as possible into the domestic market. Every policy would have to be judged based on how much it led to internal development and avoided the purchasing of foreign products. Boosting exports could help too, but government-led export booms are more difficult to achieve.

The real key to British prosperity moving forward would be to have consumers buy British. At present, imports make up around 31 percent of GDP. Almost one in three goods or services purchased in Britain today is from abroad. Policymakers should try to get that number down to at least 20 percent.

The easiest way to do this would be to examine carefully what Britain is importing. Those products that can easily be produced domestically should be produced domestically. The government should incentivize and even subsidize domestic businesses to make products that can replace their international counterparts. To put it bluntly, there is no reason that Britain should not be producing its own cars and household appliances. They have done it before. If British engineers at Rolls Royce can make jet engines, they can figure out how to build a toaster or remember how to build a small car.

Microeconomists will complain that these products will likely be inferior to their international competitors. The British microeconomists will remind us of the days, not so long ago, when Britons drove shabby Rover cars instead of streamlined German models. But, again, British living standards are destined to fall regardless, and it is better that the British people have access to slightly inferior cars—while laying the groundwork for future growth—than it is that they find it hard to purchase a car at all.

A program of import substitution is urgently needed. The government should begin subsidizing British industry to produce goods that are currently purchased abroad. The exit from the EU in particular gives them ample scope to do this, now that they are not bound by arbitrary trade rules.

A central body should be set up, staffed by market analysts and economists, to track imports and highlight potentially substitutable items. A development bank should also be set up to issue debt that can be bought by the Bank of England to pay for such import substitution. A budget for this development bank should be set once every few years based on an annual target for import reduction. The market analysts and the economists will then direct this budget to the most promising industries.

Engineering and other relevant degrees should be subsidized by the government and secondary school students should be strongly encouraged to take classes to follow this degree path. Meanwhile, British engineers currently working abroad should be drawn home to work on the project. And those who are not doing actual engineering work, but are instead working on consulting jobs, should be brought into the fold. The effort should be done under the banner of national renewal and should have the same public spirit ethos that we saw in Britain during World War II.

It is an ambitious policy, to be sure, and it would require strong leadership. It would also require leaders to jettison the ideological baggage and the false economic history that many of them have learned from birth. But it can be done. Indeed, it must be done.

If Britain does not undertake a program of industrial renewal, the exit from the EU will be remembered as the start of a very sharp period of decline for the country. A major world power, albeit one that has already been languishing for nearly a century, will end up like one of those long dead, stuffed birds marveled at in a Victorian museum.