The question of Catalonian independence is once again receiving international attention. The secessionist movement has received renewed impetus from the institutions of the Catalonian regional government, and the Catalan people are now gravely split, almost in half, on the issue. The tension is straining the relations between the central and regional governments and affecting the Spanish political panorama as a whole.

The main point of this paper is that an apparently innocent, technical document published in 2006—and sanctified in the Spanish Parliament—has been, together with the Spanish economic crisis, a major cause of the recent rise in Catalan separatism.1 This document, which discussed two methodologies for calculating regional fiscal balances, has led people to believe that Catalonia is (at least under one of the two proposed methodologies) fiscally mistreated, thus contributing to a sense of grievance within Catalan society.

However, as we will see, the monetary flow approach to calculating regional fiscal imbalances—the methodology invariably preferred by the Catalan government because it always shows higher fiscal deficits—is deeply flawed. In fact it does not (and did not) have any theoretical basis to be used in the first place. Leading Catalan economists have invested a great amount of intellectual capital in defending this approach, but this methodology has yet to be examined thoroughly.

The importance of this issue of fiscal balances in the Spanish media, and in general political discourse, should not be underestimated. In fact, as this paper was about to be submitted, Catalonia’s regional government (Generalitat de Catalunya) published the region’s fiscal balance for the years 2013 and 2014.2 In our view, this fact strengthens the point we will make in this paper, and it is not a coincidence that the regional government has chosen to publish the latest version of the regional fiscal balances just before the regional elections scheduled to take place on December 21. The regional fiscal balances, and the methodology used to compute them, has been one of the most powerful economic propaganda tools used in recent times by any democratic government. The Catalan regional government is well aware of this, and is simply using this data once again to tilt the balance of the regional elections in its favor. The controversy surrounding fiscal balances and how to compute them is, therefore, as important as ever.

Spanish Regional Administrative Structure

In order to understand some of the issues involved in the fiscal balances discussion, some background on how Spain is administratively organized may be needed. Spain is structured as a “State of Autonomies.” According to the OECD, “Spain is now one of the most decentralized countries of the OECD”,3 and is comparable to the most decentralized countries in Europe (Switzerland, Germany, and Belgium) and the United States. Spain is subdivided in seventeen autonomous communities and two autonomous cities (Ceuta and Melilla), all of which have their own elected parliaments, governments, local public administrations, and budgets. The main fiscal responsibilities of the autonomous communities are the provision of universal and free health care and education. Finally, two autonomous communities, the Basque Country and Navarre, manage their own public finances on (“foral”) historical provisions, having a higher degree of fiscal autonomy. Additionally, in Catalonia, the Basque Country, Navarre, and the Canary Islands, an autonomous police force replaces most of the functions of the state police.

These seventeen autonomies may be considered similar to any of the states in United States, or Länder in Germany. It is in practice a federal arrangement, even though it is not called as such. Madrid, the capital city of Spain, is inside the larger autonomous community of Madrid, and it does not function as a federal district or similar structure. It has its own mayor and functions, for the most part, in the same way as any other town in Spain. The only distinction is that it is where the Spanish parliament sits, and where the office of the president and most of the ministries and central government agencies are located.

Ministries and agencies have delegations in the autonomies; this structure (ministries, agencies, and delegations) may be called the central government. Two central government agencies, the Tax Agency and the Social Security Treasury (Agencia Tributaria and the Tesorería de la Seguridad Social), collect the bulk of taxes in Spain (apart from local and other minor taxes): personal and corporate income taxes, value added taxes (VAT), special taxes, and social security contributions. Social security disbursements are made directly to beneficiaries, and out of the rest of the tax income the central government finances its expenses (defense, police, justice, foreign affairs, ministries, and agencies) and, most importantly, distributes to the autonomous communities the funds needed to comply with the functions assigned to them by the constitution and statutes of regional autonomy: mostly universal and free health care and education. Within this fiscal arrangement, it is relatively easy to conceptualize a fiscal balance of the regions with the central government.

Causes of the New Independence Movement in Catalonia

Without the economic crisis of 2009 there would not have been such a political maelstrom. This crisis has been much more severe than the one Spain suffered at the time of the Great Depression.4 Secessionist sentiment in Catalonia has always been latent, but it was a decidedly minority view until recent years—supported by around 15 percent of the Catalan population. The following graph plots the unemployment rate in Catalonia against support for independence from the period before the crisis:

As in the rest of Spain, Catalonia’s unemployment rate peaked in the first half of 2013, as the Spanish banking crisis deepened and the consequences of years of austerity policies (and tight monetary policy) in the rest of Europe unfolded. An overvalued currency and high oil prices during the period (2011–2013) also contributed to the deepening of the crisis. However, from 2013 onwards, as many of these negative factors have disappeared and the performance of the Spanish external sector has been healthy, the Spanish economy has made a turnaround, and with it, the Catalan economy.

Apart from the economic crisis, the second most important cause of the rise of Catalan secessionism has been the concept that “Spain is robbing us” (“Espanya ens roba”, “España nos roba”).6 This concept started to exert significant sway in the second quarter of 2012, and it took off spectacularly as a mantra following the Diada of September 11, 2012. Diadas are massive demonstrations carefully staged by separatists celebrating the Catalan Day (September 11) every year. They have assembled crowds ranging between 550,000 people in 2014 to 220,000 in 2017, knowing that through this exercise they display their might and strength. From the Diada of 2012, “Espanya ens roba” has been the battle cry of the separatist movement (recently joined with “the right to decide”). You can see the dramatic increase in support for independence from the moment the mantra started to take hold (in the first half of 2012) to the months following the Diada of 2012. Support for independence increased from 29 percent in the first quarter of 2012 to 46.4 percent in the first quarter of 2013, a 60 percent increase in less than a year.

As we will show, such a dramatic increase was the result of the release of a document published by Catalonia’s regional government, which displayed the unfavorable Catalan position in regard to fiscal balances.7 We now turn to how this result was achieved.

A Tale of Two Fiscal Balances

In Catalonia, “Espanya ens roba” is not seen as a philosophical or vaguely defined idea, but considered a precise scientific fact (though a doubtful one, as we will see), a statistically defined “fiscal balance.” A fiscal balance is a tool to calculate how much somebody “robs” or “is robbed” by the government: the difference between how much you pay in taxes and how much money and valued public services you receive from it. Adding all the inhabitants of a region you can calculate the fiscal balance of the place. This statistic, published in Catalonia’s Fiscal Balances according to the methodology endorsed by the Catalan government, showed that Catalonia had a fiscal deficit of 8.5 percent of its GDP in 2009, which was rhetorically enlarged to “almost a tithe” by Andreu Mas Colell, who was, at the time, Finance Minister of Catalonia’s regional government.8 Quite a robbery!

The preparation of regional fiscal balances is a Spanish specialty: the country probably produces more of this sort of data than the rest of the world combined. This is simply because it is at the core of the separatist strategy. Spain is likely the only country with an official parliament-sanctified methodology on how to prepare them. There are two such methodologies, in fact, which is at the heart of the problem.

Properly prepared regional fiscal balances, calculated under a methodology that every economist would easily endorse—the so-called burden/benefit approach—have shown the deficit of Catalonia for 2009 to be around 11.3 billion euros, or 5.8 percent of Catalonia’s GDP. This figure is much lower than the 8.5 percent calculated following the second official methodology, called monetary flow. The 5.8 percent figure obtained under the burden/benefit approach has been compared to fiscal deficits in other countries/regions and found to be normal; certainly not much to cry about. Richer regions pay more than they receive, Catalonia being a standard case, not a specially discriminated against region. Ángel de la Fuente, one of the foremost experts on fiscal balances, has been comparing the situation of Catalonia with other regions of other countries that are in a similar situation to Catalonia, finding no discrimination.9 In fact, doing a back-of-the-envelope calculation, if your income is 18 percent higher than average (the situation of Catalonia’s per capita income compared with the Spanish average), paying taxes at the combined rate of 35 percent, and receiving transfers (monetary and in kind) at the average (all Spaniards treated equally), you will have a fiscal deficit of 5.3 percent. Such a deficit is not enough to justify any complaints about fiscal plunder.

Facing this situation, separatist Catalonian economists started to think, around the year 2000, of new arguments to substantiate claims of higher fiscal deficits. They began providing a theoretical justification for a methodology sometimes used in the past because of its simplicity, when there was a lack of data, or a lack of time for the burden/benefit approach to be practicable. This alternative methodology is called the burden/expenditure method in economics literature, though in Spain it is called the monetary flow approach.10

Although the monetary approach was frequently used in the past, it never had any strong economic justification. The novel justification came from a comparison between Catalonia and Madrid, a region with higher per capita GDP and whose fiscal deficit is substantially higher than in Catalonia (10 percent of regional GDP in the burden/benefit approach), but where a large portion of central government expenditures (e.g. payments to civil servants) are disbursed. In Catalonia, as in the rest of Spain, there are not many central government civil servants working there. Under the burden/benefit approach, the cost of this activity is proportionally shared as a “benefit” according to the population of the different regions. Social security civil servants, for example, have a job that benefits everybody in Spain, independently of where they live. So, according to this approach, given that Catalonia has a larger population (7.5 million) than Madrid (6.5 million), Catalonia gets more benefits than Madrid from the provision of central services like social security.

The monetary approach does not take these benefits into account, however. It only takes into account the volume of expenditures disbursed in every region. Madrid is where the volume of expenditures is higher so, according to this approach, Madrid benefits more than Catalonia, making it a richer region. Following this line of reasoning, the advocates of the monetary approach proceeded to easily amend other accounts of the benefit/burden approach fiscal balance according to their monetary flow framework—for instance, the benefits from defense expenditures carried out by the Spanish central government. Given that out of the 120,000 personnel of the army, navy, and air force, only 2,000 are based in Catalonia, according to the monetary approach, Catalonia gets few benefits from defense expenditures. Under the burden/benefit approach, the regions benefit based on their population, on the reasonable idea that everyone benefits from the defense provided by the army, regardless of where the forces are based. In addition to these central government expenses and defense expenditures that are said not to benefit Catalonia, other major adjustments include public expenditures on infrastructure, expenditures of autonomous organizations, foreign affairs, as well as a complex process to neutralize the effects of the high government deficit (10 percent of GDP in 2009), which requires that overall the regions spend more than their revenues. All these adjustments, taken together, amount to 5.2 billion euros, raising the total deficit from 11.3 up to 16.4 billion euros, or 8.5 percent of Catalonia’s GDP, a number that now could be trumpeted as unacceptably high.11

To give an example to further clarify the differences between the two approaches, there is a central government agency, Imserso, under the Ministry of Health, that runs a popular program between Spanish retirees. It subsidizes approximately 20 percent of the cost of the winter holidays of applicants to the program, negotiating low prices with the tourism industry and making use of the large hotel infrastructure of Spain, which is underutilized in winter. Under the burden/benefit approach, Catalan retirees holidaying in Andalusia appear as beneficiaries of this subsidy. Under the monetary flow approach, the beneficiaries are not retirees, but the hotels in Andalusia and providers of transport services.

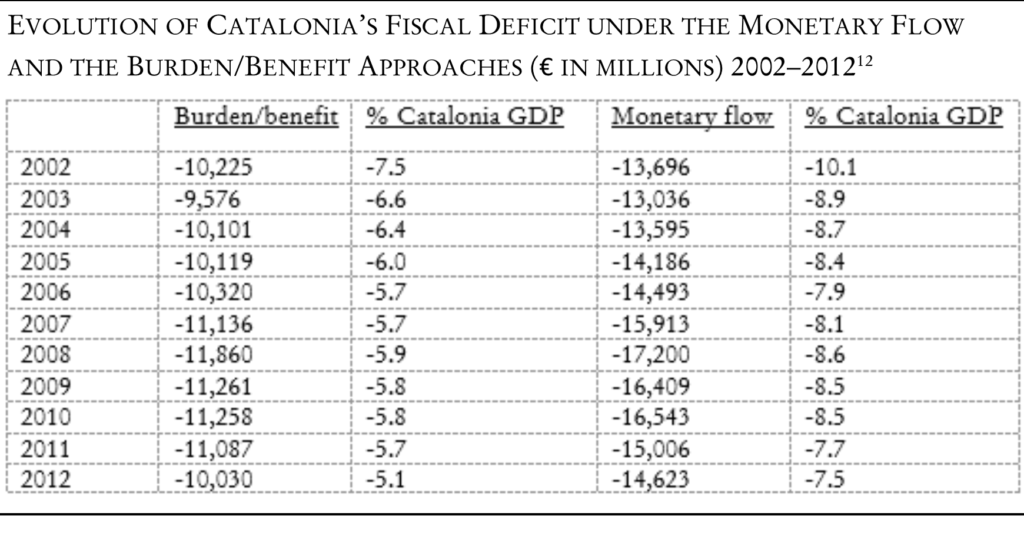

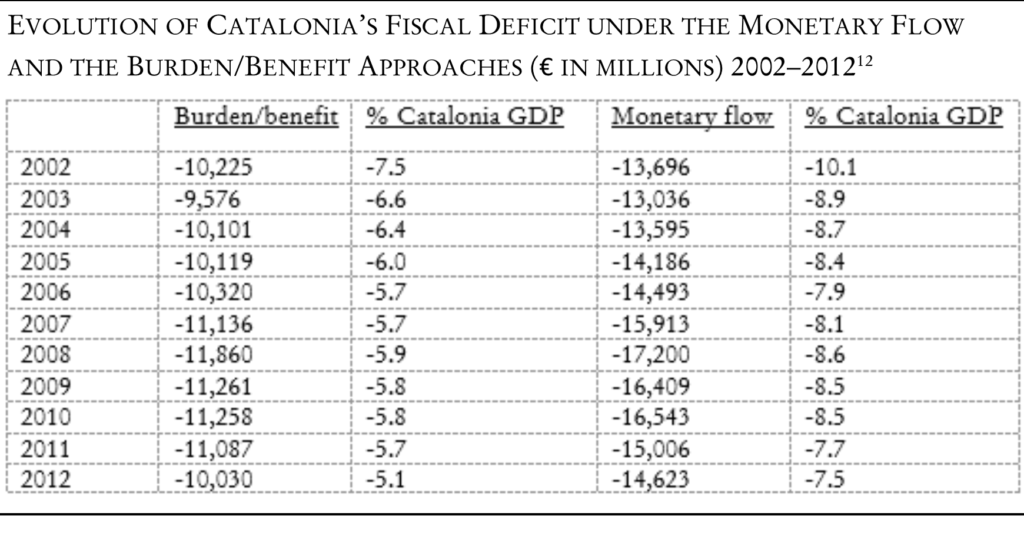

The following table displays the evolution of Catalonia’s fiscal deficit under the two approaches from 2002 to 2014, showing that the difference between the two methodologies has remained broadly stable, from 2–3 percent of Catalonia’s GDP:

The Monetary Flow Approach Is Made Official

These exercises in creative accounting by separatist economists would have proved pointless were it not for the fact that the Spanish socialist party (PSOE) won the elections in March 2004 under the influence of the terrorist strikes of March 11. The socialist government agreed with Catalan separatists to create in 2005 a working group (appointed by congress September 21, 2004) whose aim was “to establish a common methodology to calculate fiscal balances that allows for the determination of the annual financial flows between the Autonomous Communities and the Central Government, taking into account the highest possible territorial allocation of revenues and expenditures.”13 With the new government in power, Catalan economists thought that they had a chance to incorporate their methodology into an official document.

The working group was established by the Resolution of April 14,, 2005, under the chair of Jesús Ruiz-Huerta Carbonell, Executive Chair of the Institute of Fiscal Studies (Instituto de Estudios Fiscales), and with the participation of government representatives (IGAE, INE and other institutions), research staff from several universities, and from the Institute of Fiscal Studies. In total, the working group was composed of thirteen specialists.

The main document where the methodology to elaborate the Spanish regional fiscal balances is carefully laid out is the Report on the methodology to calculate regional fiscal balances.14 The importance of this document cannot be understated; it is a document that was commissioned by the Spanish Parliament to analyse what was considered a key issue.

Concerning the methodological approach to calculate fiscal balances and justifying the decisions taken in the report, the working group stated:

In the first place, the Working Group has highlighted the validity of the two main methodological approaches with which this calculation can be approached: the “burden-benefit” approach . . . and the “monetary flow” approach . . . .

The “burden-benefit” approach seeks to assess the effects that the actions of the institutions of the central public sector cause to the well-being of people residing in a given territory. The measurement of these effects is done in terms of “equivalent” change in the level of disposable income of these people. In the case of receipts, the reduction in purchasing capacity caused by the tax burden borne is taken as a reference. In the case of outlays, the increase in purchase capacity due to the receipt of cash transfers and the savings derived from the free consumption of public services. The resulting balance seeks to measure the redistributive effects of the actions of the central public sector in each territory, after accounting for the participation of its residents in the burdens and benefits of its financial activity.

For its part, the “monetary flow” approach seeks to assess the effects that the actions of the institutions of the central public sector cause on economic activity in a given territory, determining how their economic macromagnitudes vary in terms of production and consumption, and on income and public payments located in each territory. In the case of receipts, the monetary flow caused by the taxation of localized wealth, of the income generated and of consumption made in that territory is taken as reference. In the case of expenses, the monetary flow motivated by the public investment and consumption made and the transfers in kind and in cash received in that territory. The resulting balance tries to summarize the effects that the whole of the revenues and expenditures of the public sector Central government induces economic activity in each territory, regardless of the residence of those who bear the burden and those who obtain the benefits. The different income and expenditure categories have very different effects on income or economic activity, so the resulting balance is more difficult to interpret. In this approach, the separate analysis of the different income and expense items is more relevant. 15

The first paragraph’s suggestion of two main approaches is an audacious proposition. To put the benefit approach, widely considered to be an acceptable one,16 on equal terms with the monetary flow approach, which had only been sponsored by a handful of economists (all of them based in Catalonia) and that has never been given adequate scrutiny in peer-reviewed journals or in first-class conferences, is especially striking. The rest of the above is an exercise in justifying the monetary flow. How a group of thirteen so-called experts on fiscal balances could reach this Solomonic decision should require additional substantiation that is lacking in the document. Nor is it clear that they spent much time thinking about it; they were replicating more or less verbatim how this reasoning appeared in previous Catalan documents.17

In addition to this group of experts, a number of well-known Catalan economists have eagerly endorsed the monetary approach: Andreu Mas-Colell as we have indicated, as well as a group of Catalan economists calling themselves the Wilson Initiative, including Xavier Sala i Martín, Jordi Galí, Pol Antràs, Carles Boix, Gerard Padró i Miquel and Jaume Ventura.18

Armed in this way with an officially endorsed methodology, the Catalonian regional government went to prepare the Catalonian fiscal balances for 2006–2009, which appeared in May 2012, as already mentioned.19 This document, together with the skillful use of the monetary deficit figure by the regional authorities (slogans such as “the 16,000 million plunder,” “Spain is robbing us,” and Mas-Colell’s “tithe”) and its propagation in the media and the diada of 2012, created the conditions for the separatist fever that erupted in the last months of 2012. Since then, support for independence has diminished somewhat, thanks in part to the overall economic recovery—though a supposed fiscal discrimination is still strongly embedded in the Catalan perspective.

The Pitfalls of the Monetary Flow Approach

There have been some efforts to counteract separatists’ methodology, most prominently that of Josep Borrell, former socialist minister and president of the European Parliament from 2004 to 2007.20 Although Borrell’s analysis is valuable, it is too focused on the conclusions that should be drawn from the monetary approach, rather than overthrowing its conceptual foundations.

On the other hand, the current Spanish government, without formally repudiating the monetary approach, has been endorsing a series of studies that improve upon the burden/benefit methodology mainly developed by Ángel de la Fuente, Ramón Barberán, and Ezequiel Uriel.21 It is an enormous undertaking, specifically designed to help clarify regional finances. In these reports the Catalonian fiscal deficit has been shown to be around 5 percent of its GDP. While the authors of the new system specifically deny that the monetary flow approach has any importance as a fiscal balance measure, stating that it is plainly wrong, they have not developed theoretically precise arguments explaining its erroneous premises, preferring not to become entangled in what they may consider a waste of time.22

Catalonia’s government pays scant attention to these studies and continues to publish its own fiscal balance reports emphasizing the monetary flow concept. Mas-Colell has continued to insist on the importance of the monetary approach.23 The concept is thus still firmly defended by separatist economists. As we noted in the introduction, a report with the latest numbers for 2013 and 2014 was published just a few days ago, in timely fashion given the regional elections that will be held on December 21.

The monetary approach has a simple and attractive appeal, which is deceptive if you do not pay careful attention. Public expenditure turns out to be highly visible, displaying positive economic effects (through the remuneration to the “factors of production”), but it hides costs that are not so readily visible. When Catalonians argue that defense expenditures do not benefit them (so these expenditures should not be counted as benefit, since the expenditure is incurred in other regions where the military units are based), it is easy to overlook the fact that, absent these expenditures, Catalonia would have to provide for its own defense—and that that implies a significant cost.24

In more theoretical terms, the monetary flow approach selectively employs the concepts of neoclassical microeconomics to justify Catalonian regional mercantilism. It intentionally confuses how benefits and costs are calculated for individuals and regions in order to make Catalonia appear disadvantaged. A consistent microeconomist, for example, would treat payments to individuals—like the salaries of defense personnel—as being offset by some opportunity cost. Individuals have to work for those salaries, which prevents them from doing other things. Furthermore, the individuals paying their salaries must derive some benefit from the services provided, according to the principles of microeconomics. But the separatist economists simply treat these payments as regional transfers or macro-phenomena. Madrid receives nothing but benefits; Catalonia bears nothing but costs. On the other hand, a consistent macroeconomist would have to acknowledge that if the central government stopped providing for national defense, then Catalonia would have to bear an added cost to support its own defense. In this way, the monetary approach is an inherently ill-designed methodology for calculating fiscal balances because it does away with several costs that an economist cannot obviate. It is not only a world of costs without benefits, and but it is also a world of benefits without costs, an affront to the most basic accounting framework. The group of experts (and the mainstream economists of the Wilson Initiative) have effectively disavowed their neoclassical background by embracing the monetary flow approach, yet they have done so without adopting a consistent macroeconomics.

The above explanation should definitively serve to eliminate the concept of the monetary flow from the toolkit of economic analysis, but in the Spanish case the errors go even further. The group of experts behind the monetary flow methodology has shown a deep ignorance of the functioning of the Spanish economy, ignoring the revenues generated by Catalonia from selling into the Spanish public sector.

In Spain, apart from central government public expenditures, there are large public expenditures carried out by the various regional governments, for which they are allocated funds collected by the central government. This is basically for the provision of public health and education services. Catalonia receives in its favour a highly disproportionate percentage of these expenses, approximately 14–16 billion euros in net terms. The bulk of this amount comes from purchases of pharmaceutical products (medicines), medical equipment, instruments, accessories, and maintenance and management services of the health care sector.25 To these health care purchases, we must add revenues from the national education sector and public research: scientific and laboratory equipment, management software of all kinds, and a number of additional products. In fact, the most distinctive characteristic of the Catalan economy is its specialization in selling to the Spanish regional public sector. All this is hidden due to the way in which the fiscal balance is calculated in the monetary flow approach.

This leads to situations that can be considered amusing, were it not for the damage they have done. Under the monetary flow approach, when the regional government of Andalusia spends 2.5 billion euros annually on Catalan products and services,26 all that expense is shown to generate economic effects (the effect that the monetary approach intends to highlight) in Andalusia—yes, this is not a typo, in Andalusia. Under the monetary flow method, all public expenditures have to produce economic effects and affect the creation of employment somewhere; as this expense has no effect in Catalonia according to the monetary flow approach, it must be in Andalusia. So the more Andalusia spends in Catalonia, the more employment is generated in Andalusia, according to this methodology. No wonder Catalonia is robbed!

How could this outcome have happened? How could so many gross errors be committed by supposed experts in this field? Actually, we believe, it is the result of a careful procedure set in place by Catalan economists to obfuscate this reality—and the rest of the members of the parliamentary working group did not see this. In the burden/benefit method, a balance of transfers (not of payments for goods and services) is computed,27 and one can disregard the effect of inter-regional inflows/outflows because there are no transfers of public funds between the different Spanish regions, only transfers between the different regions and the central government.28 This unique aspect of the application of the burden/benefit method to the Spanish administrative framework (which does not require the consideration of fiscal transfers between the regions, only transfers between the central government and the regions) was applied by the pro-separatist economists without modification to the monetary flow method. In this way, their methodology hides a significant flow of expenditures for the provision of goods and services—and its economic and employment effects—that goes largely to Catalonia as a final destination.

Catalan businessmen know all this very well, but the experts of the working group did not adequately account for these facts. The regional fiscal expenditures of Spain in Catalonia, about 14 to 16 billion euros, should be considered in any computation of the monetary flow balance, in addition to the expenditures of the central government—though the separatist group of experts uses only the accounts of the central government, excluding the regions. In other words, a properly computed monetary flow method (if it were indicative of anything) would indicate a balance of roughly zero, a conclusion that would scare Catalan separatists, were it widely known.

As a final remark, it should be pointed out that we are not advocating the use of a modified monetary flow method to compute fiscal balances, but rather explaining how it should be computed properly.

Conclusions

Anyway, here we are. An apparently innocent official document, including a misguided economic concept, the monetary flow method, has ended up producing devastating social consequences, obscuring a correct understanding of the reality of the Catalan economy within Spain for millions. Should economists in the future want to check Keynes’ assertion about the relevance of economic theories in the policy arena, they would not have to look further than what has been exposed here—only that in this case, sadly, the influence has been for the worse.

The monetary flow approach, pushed forward by secessionist economists, should not have been approved by parliament and has helped to create regional grievances among the Catalan people. The burden/benefit approach makes broad assumptions about how benefits are distributed across regions, but at least such benefits are theoretically sound and fully accounted for. The monetary flow approach, however, faces even more formidable problems, distorting the fundamental economic meaning of expenditures. Although appealing at first glance, monetary flow does not provide a meaningful measure of a region’s economic situation, failing to properly account for both costs and benefits.

It is possible to properly compute regional fiscal balances in a country. There is enough experience in doing that properly following the burden/benefit approach. But we should also point out that most of the countries of the world do not prepare such accounts, and they function perfectly well without them. If a fair tax system is put in place, and government expenditures are redistributed in a fair way, this is all anyone needs to know. Regional aggregates do not provide any additional economic knowledge, nor do they provide any insight into the fairness of the tax/expenditure system—they only supply the means for demanding preferential treatment of one region over the others. For this reason, we would heartily advise against attaching excessive importance to regional fiscal balances, because in the end they are a tool to propagate division.

Finally, American universities have endowed titles, honors, and chairs to economists who, in their own simplistic worlds of general equilibrium models, neoclassical growth theory, or neo-Keynesian economics, toy with concepts thankfully disconnected from the social world, and where not much damage can be done.29 In Spain, however, out of the reach and vigilance of their peers, these economists have engaged in what can only be described as economic hooliganism, promoting all kinds of economic nonsense with disastrous results. Aside from sponsoring pseudoscientific concepts out of self-interest, they have been guaranteeing that a clean, painless economic separation could easily be carried out.

Yet in the world of facts, these economists have been confronted (or rather, the Catalan people have been confronted) with a ghastly nightmare. At the first hint of a possible secession, over the three weeks from October 7–21, 2017, 60 percent of the largest 3,000 companies in Catalonia changed their legal address to other regions of Spain, including all the important financial institutions—a massive stampede, signaling more economic damage to come. If this trend continues apace, the relatively prosperous Catalonian economy will be in tatters for at least a generation.

Notes

The authors gratefully acknowledge useful comments and suggestions from Edward Worsdell and Rafael Wildauer. Any remaining errors are our sole responsibility.

1 Instituto de Estudios Fiscales (2006), Informe sobre Metodología de Cálculo de las Balanzas Fiscales, p.9. It can be downloaded in Spanish from http://www.minhafp.gob.es/Documentacion/Publico/GabineteMinistro/Varios/Metodologia_BalanzasFiscales.pdf.

2 Generalitat de Catalunya (2017), Els Resultats de la Balança Fiscal de Catalunya amb el Sector Públic Central els Anys 2013 i 2014, http://economia.gencat.cat/web/.content/70_analisi_finances_publiques_balanca_fiscal/arxius/resultats-BF-2013-2014.pdf.

3 https://www.oecd.org/regional/regional-policy/profile-Spain.pdf.

4 See González Calleja, E. et al. (2015), La Segunda República Española, Ediciones de Pasado y Presente, pp. 660-661, where it is reported that between 1929 and 1935 GDP remained flat, peaking the unemployment rate at 7 percent in the worst moment of the crisis.

5 Source: Instituto Nacional de Estadística (INE) for the regional unemployment rate and Centre d’Estudis d’Opinió (CEO) for the support for independence. The support for independence figure has been taken from a regular survey (Political Opinion Barometer) asking the question “Do you believe that Catalonia should be…?” The observations for 4Q’11, 3Q’12, 3Q’13 and 3Q’14 have been taken from the previous quarter, due to missing observations.

6 As the Huffington Post (2017) shows, “Spain is robbing us” has been “[o]ne of the most successful slogans in recent years”. See https://www.huffingtonpost.com/entry/catalonia-independence-referendum-things-to-know_us_59cd4b15e4b0300a59ac149d.

7 Generalitat de Catalunya (2012), Resultados de la balanza fiscal de Cataluña con el sector público central 2006-2009, http://economia.gencat.cat/ca/70_ambits_actuacio/analisi_finances_publiques/la_balanca_fiscal_de_catalunya_amb_l_administracio_central/.

8 https://politica.elpais.com/politica/2012/03/12/actualidad/1331586807_232711.html.

9 See de la Fuente (2014), Is Catalonia being Fiscally Mistreated?, Barcelona GSE Working Paper Series Working Paper nº 766.

10 Even though there are some differences as how receipts are treated, the main difference between the two approaches come as result as to how government expenditures are treated.

11 Even though years have passed and fiscal balances figures have changed, the numbers of the 2009 are the ones still bandied about, especially the 16.000 million plunder.

12 Source: Generalitat de Catalunya (2016), Els resultats de la balança fiscal de Catalunya amb el sector públic central

l’any 2012, p. 18. http://economia.gencat.cat/web/.content/70_analisi_finances_publiques_balanca_fiscal/arxius/resultats-BF-2012.pdf. We do not take into account here the latest numbers published in Generalitat de Catalunya (2017), ibídem, because these numbers were not known at the time. The latest numbers are in line with the ones shown here up to 2009; from there on, there are small discrepancies due to (presumably) revisions that do not bear any influence on the issue discussed here.

13 Instituto de Estudios Fiscales (2006), ibídem.

14 Instituto de Estudios Fiscales (2006), ibídem.

15 Instituto de Estudios Fiscales (2006), p.9 and p.92.

16 One of the most intriguing questions still to be explained is why there remains a serious inconsistency in the documents provided to the Spanish senate, inconsistency that should have been addressed. As part of the effort for the creation of the methodology and to help the group of experts, the Working Group commissioned Ramón Barberán –one of the member of the working group- to prepare a document reviewing past efforts on creating fiscal balances and the theoretical soundness of it all. This review document is attached to the main body of the Report. In it, Mr. Barberán clearly states that “all of which inevitably leads to identifying the burden-benefit approach as the ideal one for calculating fiscal balances and discarding other approaches (collection-payment approach, burden-expenditure approach and income-expenditure approach)… Therefore, interest in macroeconomic effects would not justify the application of discarded approaches, in particular the burden-expenditure approach, that simply puts research outside the scope of fiscal balances to place it in the scope of regional accounting (regional accounts of the central public administration), in which the calculated magnitudes have a precise macroeconomic meaning” (p.144).

The burden/expenditure approach in the quote is the monetary flow approach we are considering.

17 Generalitat de Catalunya (2005), La Balança Fiscal de Catalunya amb L’Administració Central. http://economia.gencat.cat/web/.content/documents/arxius/document_del_grup_de_treball_2005_catala.pdf.

18 http://www.wilson.cat/en/qui-som.html.; https://www.wsj.com/articles/catalan-academics-press-separatist-drive-1390608191

19 Generalitat de Catalunya (2012), ibídem.

20 Borrell,J. & Llorach, J. (2015), Las cuentas y los cuentos de la independencia, Editorial La Catarata.

21 These reports can be found in Spanish for the years 2011-2014 in http://www.minhafp.gob.es/es-ES/CDI/Paginas/OtraInformacionEconomica/Sistema-cuentas-territorializadas-2014.aspx.

22 As Barberán states, “The flow approach, on the other hand, has traditionally been defended on the grounds that it serves to evaluate the macroeconomic impact caused by the budgetary activity of the central government in each region. However, the suitability of this approach for this purpose does not stand up to critical analysis, and as such seems dispensable. Recently, in fact, it has been attributed another purpose: the quantification of the fiscal dividend of a region’s independence. But there are several contraindications to accept that the net fiscal flow from the flow approach is the equivalent of this dividend.” Barberán, Ramón (2014), The Methodological Debate on Inter-regional Fiscal Balances: An Element of Confusion for the Citizens, Institut d’Economia de Barcelona. http://www.ieb.ub.edu/es/20140723370/noticias/diferencies-metodologiques-per-elaborar-balances-fiscals-objecte-del-darrer-ieb-report#.Wf5AMmjWzIU.

23 https://www.ara.cat/opinio/que-cou-deficit-fiscal_0_1619238094.html.

24 Separatist economists sometimes recognize this, but counteract saying that at least this creates jobs in Catalonia, hindering the fact that these expenditures, instead of being a benefit, they are a use of resources not particularly productive.

25 The Spanish market of pharmaceutical specialties in 2009 amounted to 14,863 million euros at laboratory prices – i.e. excluding margins of distributors and pharmacies (Farmaindustria (2011), Annual report, p.132). If we add another 1,700 million in other hospital supplies related not strictly to pharmaceutical specialties, we obtain a total of 16,563 million, of which 75 percent correspond to the public health system. That is, the public health system spent a total of 12,422 million euro of these products. The Catalan pharmaceutical industry accounts for 60 percent of the Spanish total (to give an idea of its relative importance), which would mean 7,453 million euros of public purchases to Catalan pharmaceutical companies.

26 Andalusia’s population is roughly 18 percent of Spain, so we can approach the expenses on Catalan products to 2.5–2.9 billion euros.

27 In economics, a transfer payment is “a transaction in which one institutional unit provides a good, service or asset to

another unit without receiving from the latter any good, service or asset in return as a direct counterpart” (System of National Accounts, 2008, p.161). These payments are considered to be non-exhaustive because they do not directly absorb resources or create output. The proper way to compute a fiscal balance is to net the negative transfers you incur (taxes and similar payments that have no relation to any economic activity you provide to the state) with the positive transfers received (monetary payments like pensions, unemployment insurance and subsidies, and transfers in kind, as health and education services).

28 In Germany, however, regional transfers should be considered, since there are transfers between the Länder to execute the appropriate fiscal leveling, as Länder collect personal income taxes and VAT.

29 Although, alas, this is also being less and less the case. Consider, for instance, the wave of studies published since 2010 to provide a justification for the austerity policies enacted across Europe. See Blyth, M. (2013), Austerity. The History of a Dangerous Idea, chapter 5, for a summary of this literature.